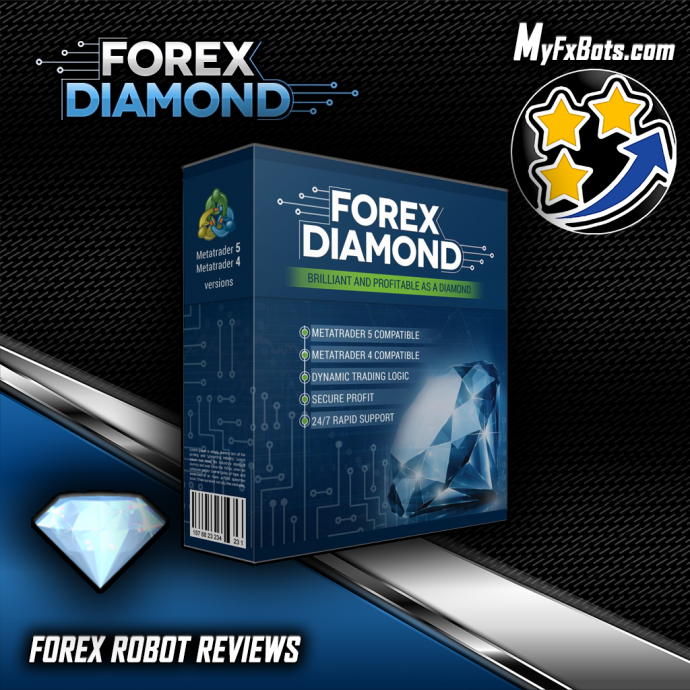

Heiken Ashi and Commodity Channel Index (CCI) are very interesting and popular forex indicators. There are many trading strategies that are based on these two indicators. But in this article, we will explain how to combine both to trade in forex with higher precision.

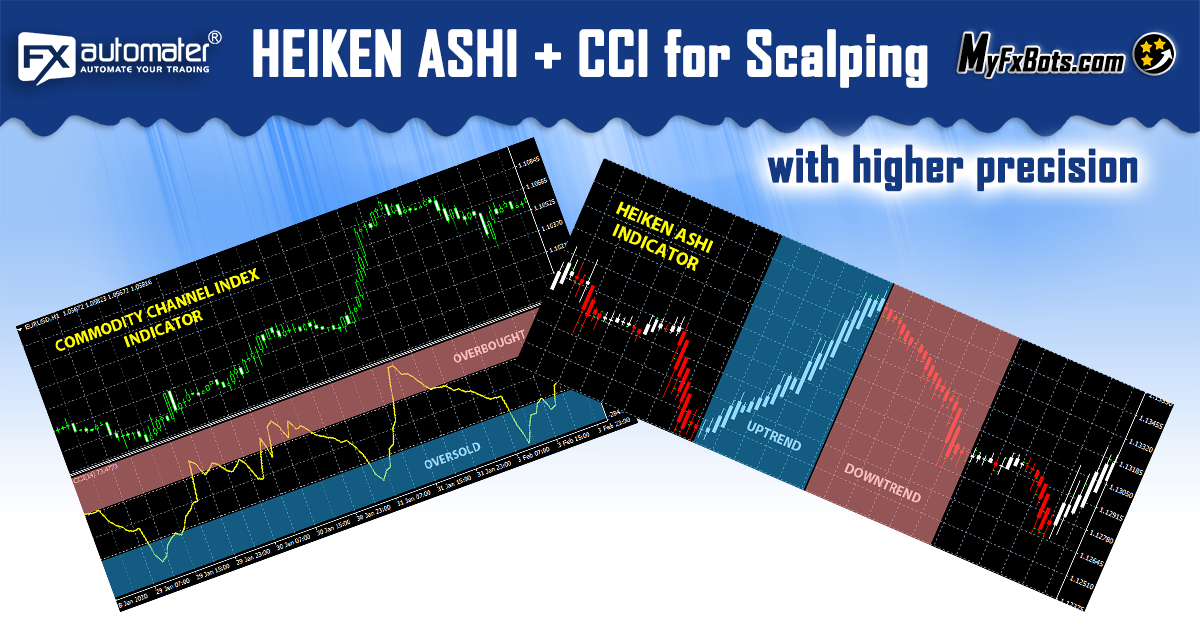

What is Heiken Ashi?

Heiken Ashi is a Japanese trading indicator that means "average pace". Heiken Ashi charts resemble candlestick charts but have a smoother appearance as they track a range of price movements, rather than tracking every price movement as with candlesticks. Traders and investors use these charts to help determine and predict price movements.

Heiken Ashi sometimes is called "Heikin Ashi" in different articles. But it is the same indicator.

Added to the chart Heiken Ashi changes the main colors of the candles. In our case, the new colors are white and red.

White candles with no lower shadow signal a strong UPTREND.

Red candles with no upper shadow signal a strong DOWNTREND.

Switching from one color to another usually means changing the direction of the trend. Such changes are interpreted as BUY and SELL signals/opportunities. For example: switching from white candles to red candles means a SELL signal. Switching from red to white means a BUY signal. Of course, there are rules, but we will explain these rules in another article dedicated entirely to the Heiken Ashi indicator.

What is Commodity Channel Index (CCI)?

The Commodity Channel Index (CCI) is an oscillator used by traders and investors to identify price reversals, trend strength, and overbought and oversold levels. The CCI is categorized as a momentum oscillator. As with most indicators, the CCI should be used in conjunction with other aspects of technical analysis.

In general, CCI measures the current price level relative to an average price level over a given period of time. CCI is relatively high when prices are far above their average, but is relatively low when prices are far below their average. In this manner, CCI can be used to identify overbought and oversold levels.

There are also divergences—when the price is moving in the opposite direction of the indicator. If the price is rising and the CCI is falling, this can indicate a weakness in the trend

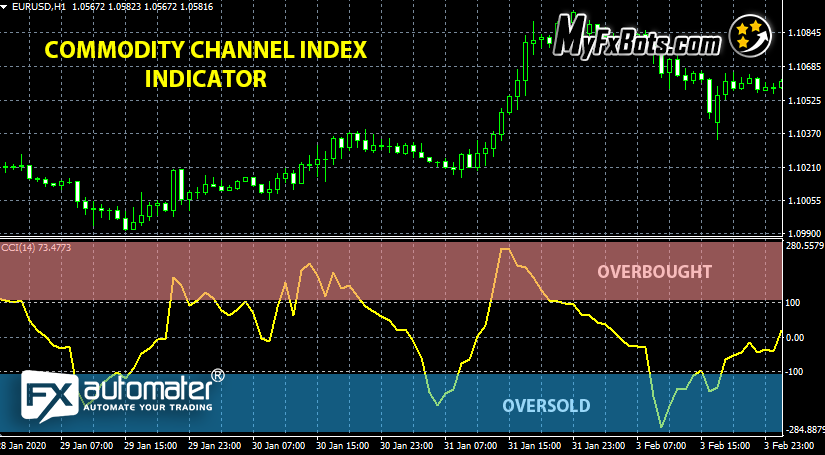

Check the below image to see what CCI looks like on the chart:

The CCI value moves above and below zero. There are two borders +100 and -100 which are very important. They are used for generating BUY and SELL signals. When the value of CCI exceeds +100, the price is considered to be entering into a strong uptrend and a buy position can be opened. When the value of CCI falls below -100, the price is considered to be in a strong downtrend and a sell position can be opened.

In our article, we will explain how to use CCI in combination with Heiken Ashi to confirm signals generated by Heiken Ashi. Continue reading to learn how to confirm Heiken Ashi signals.

How to combine Heiken Ashi with CCI for more precise trading signals?

Both forex indicators Heiken Ashi and CCI cannot boast of very accurate signals. But by combining both indicators signals we can get more accurate signals and trade with greater precision. Combining the two indicators, we also have the opportunity to close positions earlier and take the profit earlier before there is a turnaround in the market.

Instead of explaining both indicators separately, we will try to show you how to combine and use them as one single indicator.

How to open a BUY position with Heiken Ashi and CCI

In the above picture, you can see both forex indicators added to the chart. First, we will explain when to open a BUY position.

The main indicator we will look at is Heiken Ashi. We will only use CCI to confirm the Heiken Ashi signals for precision trading. When Heiken Ashi changes its color from red to white it is interpreted as a BUY signal. But before opening a BUY position, we check the CCI indicator. If the CCI line crosses the border -100 from bottom to top, this is a confirmation and we can open a BUY position. It is possible that one of the indicators rushes or slows down, i.e. signals may not match. A difference within a few bars/candles is acceptable. It is good to wait and when we have visual confirmation from both indicators to open a BUY position. If there is no confirmation, we simply skip and do not open an order. We are waiting for another opportunity.

We explained how to open BUY positions by looking at Heiken Ashi and CCI. When to close BUY positions? We have 3 closing options:

- Early closing by CCI: Look at EARLY CLOSE in the above image. When the CCI value is above 100 and there is a reversal of the value ie. forming a triangle we can close the order early and take the profit.

- Close on CCI signal: Look at CLOSE 1 in the above image. When the CCI line crosses the border 100 from top to bottom, it is a signal to close the BUY positions.

- Close on Heiken Ashi signal: Look at CLOSE 2 in the above image. When the Heiken Ashi changes its color from white to red it is usually a SELL signal but also a signal to close the BUY positions.

How to open a SELL position with Heiken Ashi and CCI

To open a SELL position, we follow the following logic: when the Heiken Ashi indicator changes its color from white to red, it is an indication that we can open a SELL position. But for greater precision, we again look at the CCI indicator for confirmation. If the CCI line crosses the border 100 from top to bottom it is taken as a confirmation and we can open a SELL position. Let's not forget that there may be a difference in the signals of both indicators. That's why we always open a SELL order upon visual confirmation from both indicators, regardless of which is the first to generate a signal and which is the last.

For SELL positions we also have three closing methods:

- Early closing by CCI: Look at EARLY CLOSE in the above image. When the CCI value is below -100 and there is a reversal of the value ie. forming a triangle we can close the order early and take the profit.

- Close on CCI signal: Look at CLOSE 1 in the above image. When the CCI line crosses the border -100 from bottom to top, it is a signal to close the SELL positions.

- Close on Heiken Ashi signal: Look at CLOSE 2 in the above image. When Heiken Ashi changes its color from red to white it is usually a BUY signal but also a signal to close SELL positions.

As we have seen above, trading with Heiken Ashi in combination with CCI is very easy and much more accurate compared to trading with only one of them. This is quite a winning strategy. Under good conditions, you can make good money.

"It is recommended to always set Stop Loss and Take Profit in the positions you open manually! This will guarantee you peace of mind and risk-free trading."

FXAutomater Buy One Get One $ 297

One Time Payment Forex Combo System $ 497

One Time Payment WallStreet Forex Robot 3.0 Domination Basic $ 1520

One Time Payment WallStreet Forex Robot 3.0 Domination Premium $ 1640

One Time Payment WallStreet Forex Robot 3.0 Domination Ultimate $ 397

One Time Payment Omega Trend $ 547

One Time Payment Forex Diamond $ 397

One Time Payment Volatility Factor Pro $ 497

One Time Payment Forex Trend Detector $ 497

One Time Payment Forex Gold Investor $ 397

One Time Payment Best Free Scalper Pro $ 397

One Time Payment Gold Scalper PRO $ 327

One Time Payment Grid Master PRO $ 327

One Time Payment News Scope EA PRO $ 397

One Time Payment Smart Scalper PRO FREE

Pips Master Pro FREE as BONUS $ 397

One Time Payment Trend Matrix EA $ 497

One Time Payment Infinity Trader EA

Latest FXAutomater Posts

MyFxBots Admin

[Last Modified On Thurs, 7 Jul 2022]MyFxBots Admin

[Last Modified On Thurs, 7 Jul 2022]Forex Combo System

As the name suggests, Forex Combo System is a collection of several subsystems, four to be clear. The most accurate description that fits it is "four different EAs joined together". The result of such an EA could be considered "Pleasant" as you will discover this yourself after some further reading, It's an easy-to-use EA and is one of the most solid automated trading systems that I've ever seen.

WallStreet Forex Robot 3.0 Domination

WallStreet Forex Robot 3.0 Domination is a scalper EA that's not limited to the Asian session, opening positions around the clock with a fairly profitable outcome, a few indicators that are shipped with Metatrader are involved creatively, so the entry signals are determined. It has retry loops for opening/closing orders, denoting a certain degree of experience with automated live trading. Although the DLL programming is sometimes an obstacle for EAs running on multiple pairs with the same DLL, in this EA, this seems to be entirely thread-safe.

Omega Trend

Forex Diamond

Volatility Factor Pro

Forex Trend Detector

It detects the final moments of a volatile market trend or session, identifies the volatility limits below which the dominant market trend is, and don't ignore the special situations when those volatility limits occur near important market levels, predict price levels that should capitalize when the market is readjusted after the volatility breakout has occurred, and finally it sets an order based on that prediction.

Forex Gold Investor

Best Free Scalper Pro

Best Free Scalper Pro is a powerful automated Forex scalping system, one of the FXAutomater family. A reputable ECN Forex broker with very tight spreads, low commissions, and minimal slippage is required as it can confirm the difference between a winning and losing trading system, especially scalping strategy ones.

Gold Scalper PRO

Gold Scalper PRO is not a grid, martingale, or using any other risky strategies, it just employs a classical trading strategy by a textbook using reasonable Stop Loss levels and a prosperous entry and exit trading logic beside an optional money management ATR based algorithm.

Grid Master PRO

Strictly ruled grid-based trading technique with safety "high frequency" scalping element.

Smart Scalper PRO

Smart Scalper PRO is very simple, but it is based on the most proven trading principle since the markets exist – enter the market in the direction of a strong market impulse after a reasonable correction is detected.

Pips Master Pro

Pips Master Pro has a Strong, pure and simple trading logic, Reasonable TP and SL levels, High spread, slippage and broker protection, Multiple currency pairs support, Low drawdown, and New, improved, highly effective exit logic.

Trend Matrix EA

Using Trend Matrix EA, traders can identify and profit from market trends. It offers a safe and reliable way to navigate the forex market with its Next Generation Loss Recovery System and reliable risk management tools.

Infinity Trader EA

Chat GPT and Gemini (developed by Google) are the two most powerful AI engines available. The Gemini AI handles real-time trading data better than Chat GPT. However, Chat GPT excels at managing complex conversation threads even though it is trained only on past data. Combining Chat GPT and Gemini AI leads to the most accurate and current trading forecasts.

AI alone, can't be reliable - a proven, solid strategy must back it up. FXAutomater deliver results that stand out with their AI-powered strategy Infinity Trader EA!

Talk about FXAutomater

Information, charts or examples contained in this blog post are for illustration and educational purposes only. It should not be considered as an advice or endorsement to purchase or sell any security or financial instrument. We do not and cannot give any kind of financial advice. No employee or persons associated with us are registered or authorized to give financial advice. We do not trade on anyone's behalf, and we do not recommend any broker. On certain occasions, we have a material link to the product or service mentioned in the article. This may be in the form of compensation or remuneration.

-

Social & Feed

- @myfxbots

- @myfxbots.Expert.Advisors

- @myfxbots.expert.advisors

- @myfxbots.expert.advisors

- @myfxbots_eas

- @myfxbots

- @myfxbots

- @myfxbots

- @myfxbots

- @myfxbots

Tags

Forex Combo System WallStreet Forex Robot 3.0 Domination Omega Trend Broker Arbitrage FX-Builder Forex Diamond Volatility Factor Pro GPS Forex Robot Tick Data Suite Vortex Trader PRO Forex Trend Detector Swing Trader PRO RayBOT Forex Gold Investor FXCharger Best Free Scalper Pro Gold Scalper PRO News Scope EA PRO Smart Scalper PRO FX Scalper Evening Scalper PRO Waka Waka Golden Pickaxe Perceptrader AI Happy Bitcoin Algocrat AI Traders Academy Club Quant Analyzer AlgoWizard Quant Data Manager InstaForex RoboForex IronFX Tickmill FXVM Alpari FX Choice TradingFX VPS Commercial Network Services VPS Forex Trader QHoster GrandCapital IC Markets FBS FX Secret Club StrategyQuant X Happy Forex LeapFX Trading Academy ForexTime Magnetic Exchange XM BlackBull Markets ForexSignals.com Libertex AMarkets HFM Broker FxPro Binance ACY Securities IV Markets Forex VPS MTeletool Forex Store Valery Trading Telegram Signal Copier Telegram Copier Forex Robot Academy Forex Robot Factory (Expert Advisor Generator) SMRT Algo EGPForex

Risk

Forex trading can involve the risk of loss beyond your initial deposit. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Forex accounts typically offer various degrees of leverage and their elevated profit potential is counterbalanced by an equally high level of risk. You should never risk more than you are prepared to lose and you should carefully take into consideration your trading experience.

Past performance and simulated results are not necessarily indicative of future performance. All the content on this site represents the sole opinion of the author and does not constitute an express recommendation to purchase any of the products described in its pages.