XM Features

There are four regulated online brokers in the XM Group:

- CySEC 120/10 regulates Trading Point of Financial Instruments Ltd, a company founded in 2009.

- The Australian Securities and Investments Commission (ASIC 443670) regulated Trading Point of Financial Instruments Pty Ltd in 2015.

- Since its establishment in 2017, XM Global Limited has been regulated by the Financial Services Commission in Belize (000261/397).

- The Dubai Financial Services Authority regulates Trading Point MENA Limited (DFSA reference number F003484).

In 2009, XM began its operations and now has clients from over 196 countries and a support team that speaks 30 languages. A comprehensive offering and favorable trading conditions make it one of the most trusted Regulated Brokers.

The main branch is located in Cyprus regulated by CySEC, but the company also has offices in Australia, the UK, Belize, Greece and Dubai.

XM is an excellent global broker that provides excellent customer support 24 hours a day. On more than 1000 trading instruments, XM offers super low spreads.

Headquartered

Cyprus (Europe)Year Founded

2009Broker Type

MM.Regulating Authorities

Islamic Account

Demo Account

Institutional Accounts

Managed Accounts

Minimum Deposit

$5Maximum Leverage

1:1000Payment Methods

Trading Platform Types

Operating Systems

Website Languages

XM Pros and Cons

As one of the most well-known brokers in the industry, XM is renowned for having a great reputation, many regulations, and a very large selection of trading instruments. In addition, XM's offering is user-friendly, its deposit requirements are among the lowest in the industry, CFD costs are average, and its platforms are very user-friendly.

You can open an XM account regardless of your net investment or trading experience, in addition to being able to engage and start trading career with webinars and research materials.

XM, however, has a limited portfolio for EU clients, and there is no good investor protection outside of EU clients.

| PROS | CONS |

|---|---|

|

|

XM Account Types and Features

With XM, you can choose from a variety of accounts, each with its own pricing structure, base currency, deposit amount, and contract length.

| Micro | Standard | XM Zero | Shares Account | |

|---|---|---|---|---|

| Client country | EEA Australia Other countries |

EEA Australia Other countries |

EAA | Non-EEA and non-Australian clients |

| Pricing | No commission, but higher spread | No commission, but higher spread | There is a commission, but the spread is very low | Market spread and commission |

| Base currencies | USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, SGD, ZAR | USD, EUR, GBP, JPY, CHF, AUD, HUF, PLN, SGD, ZAR | USD, EUR, JPY | USD |

| Minimum deposit | $5 | $5 | $5 | $10,000 |

| Contract size | 1 Lot = 1,000 | 1 Lot = 100,000 | 1 Lot = 100,000 | 1 share |

| Negative Balance Protection | Yes | Yes | Yes | Yes |

| Spreads from | 1 Pip | 1 Pip | 0.6 Pips | As per the underlying exchange |

| Commission Fee | No | No | No | Yes |

| Islamic Option | Yes | Yes | Yes | Yes |

Corporate accounts are not available at XM. The European client protection measures will not apply if you register a non-European entity.

Islamic or swap-free accounts

These are also available. If you hold a leveraged position overnight in an Islamic account, you are charged a flat commission rather than a percentage-based financing rate.

How to open an account at XM

It is quick, easy, and completely digital to open an XM account. A 20-minute application can be filled out online. It took only a day for our account to be verified.

- Enter your name, country of residence, email address, and phone number.

- Choose a trading platform (MT4 or MT5) and account type.

- Enter your name and address, as well as your date of birth.

- Leverage size and base currency can be selected.

- Answer questions about your financial knowledge and provide your financial information.

- You need to verify your identity and residency. Proof of your identity can be verified by uploading a copy of your passport, ID or driver's license, and proof of residency can be verified by uploading utility bills and bank statements.

XM Deposit & Withdrawal

There are many ways to deposit and withdraw money from XM, including credit cards, electronic payments, wire transfers, and local bank transfers. Withdrawal requests will be processed within 24 hours by the XM back office.

XM manages its funds transactions in a customer-oriented manner as well, with traders able to select from a wide variety of payment methods supported in all countries. Additionally, XM now offers local bank transfers. Many countries benefit from this because they can fund their accounts in their local currencies and banks without paying conversion fees.

A significant amount of funding methods are available to traders, but it depends on the entity you trade with. The minimum deposit is one of the lowest in the industry, and fees are either non-existent or very small.

Deposit options

Many deposit options are available with XM Trading.

- Credit cards.

- Local bank transfers (available in some regions) and bank wires.

- E-wallets including Neteller, Moneybookers Skrill, Western Union, etc.

XM minimum deposit

The minimum deposit amount for Micro Accounts and Standard Accounts at XM is 5$, while the minimum deposit amount for Zero Accounts is 100$. Depending on the payment method and validation status of the trading account, the amount may vary. The Members Area contains all the information you need.

XM Withdrawal

You can withdraw money from XM using the same methods as you deposit, including bank wire transfers, e-wallets, and credit cards. XM offers 0% withdrawal fees and no deposit fees. All transfer fees were covered by XM, which was a very pleasant addition. With no hidden fees or commissions, e-wallets, major credit cards, and wire transfers are all accepted.

Further, XM's zero-fee policy covers deposits and withdrawals above 200 USD processed by wire transfer as well, while most brokers still charge for wire transfers.

How do I withdraw from my XM Account?

Follow these steps to withdraw money from your XM trading account. Customer service can also be contacted if you have any questions or terms, as they were very responsive to us.

Withdraw money step by step

- Access your account by logging in.

- From the menu, choose 'Withdraw Funds'.

- The amount withdrawn should be entered.

- The withdrawal method should be chosen.

- Provide all the required information on the electronic request.

- You will need to confirm the withdrawal information and submit it.

- Through your Dashboard, you can check the current withdrawal status.

How long does XM withdrawal take?

It may take 1-3 business days for the XM Accounting team to process withdrawal requests, depending on the country where the money is sent. It usually takes around three working days for the money to appear on your account from standard banks within the EU. Depending on the payment method you use, some methods will process almost instantly, while others may take longer.

XM Fees and Spreads

Fees start at $5 when trading with XM.

Like the interbank forex market, XM offers variable spreads and does not restrict trading during news releases. It is more flexible to use different trading strategies when using XM fixed spreads rather than variable spreads. In other words, all trading costs are accounted for in the spread, meaning that there are no hidden fees and the tightest spread available.

You should also check not only the spread but also non-trading fees, withdrawal fees or other fees when selecting a broker, compare some of these fees below.

There might be a difference between fees for different entities, and the majority of currency pairs have an average spread, as well as additional fees like funding fees or rollovers.

| Fees | XM Fees | ForexTime Fees | AvaTrade Fees |

|---|---|---|---|

| Deposit fee | No | No | No |

| Withdrawal fee | No | No | No |

| Inactivity fee | Yes | Yes | Yes |

| Fee ranking | Average | Average | Low |

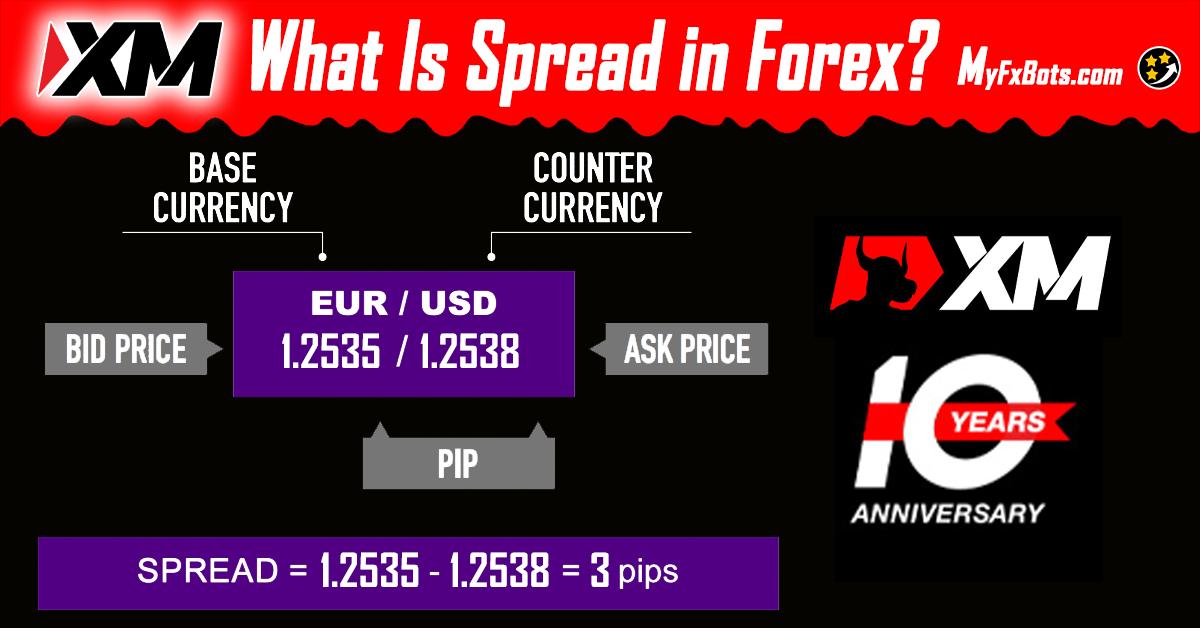

XM Spreads

XM offers spreads starting at 0.6 pips.

Micro and Standard accounts at XM are priced and charged according to a spread. In addition, XM's spread is a fractional pip price that enables the company's liquidity providers to offer the most competitive prices. By adding a fifth digit, also known as a fraction, you can benefit from even the smallest price movements.

Below are the average spreads calculated during the day for the most popular products. In spite of the fact that some spreads are higher than those offered by competitors in the industry, the overall fee structure for Forex products is average and the cost of CFDs is low.

With 1.2 pips spread for EURUSD, XM's forex spread is closer to the industry average. For professionals, commission-based accounts may be a better option.

| Asset/ Pair | XM Spread | ForexTime Spread | AvaTrade Spread |

|---|---|---|---|

| EUR USD Spread | 1.6 pips | 1.5pips | 1.3 pips |

| Crude Oil WTI Spread | 5 pips | 9 pips | 3 pips |

| Gold Spread | 35 | 9 | 40 |

| BTC USD Spread | 60 | 20 | 0.75% |

XM Commission

According to the account traders select, trading with XM involves no commissions. XM trading accounts require a minimum deposit of between $5 and $10,000.

Trading with interbank spread quotes starting from 0 pips and commission charged as a trading fee is only available with XM Zero Accounts. Transparency is a key feature of XM, and its $3.5 per lot per 100,000 USD traded is very competitive. For an easy understanding of your costs, you may also use the XM fee calculator.

Overnight fee at XM

Finally, for the fees, it is necessary to calculate the XM overnight fee, or the fee a trader pays on open positions for more than a day through a swap contract. Interest rates are calculated differently for each currency.

Suppose the interest rates in Japan and the US are 0.25% annually and 2.5% annually, correspondingly. The rollover on an open position is calculated as interest earned on borrowed currency or interest paid on purchased currency and can result in either gain or loss of USD 6.16 per day.

XM Leverage

Leverage can range from 1:1 to 1000:1 depending on account type and regulatory entity. It is always recommended to refer to your residency conditions in order to determine which leverage level you are entitled to use. There are some Group entities with no clear leverage. Group entities regulated by the EU and AU can offer clients a maximum leverage of 30:1.

Due to regulatory requirements, different XM entities apply different leverage conditions. Here are the leverage options for each entity. Leverage is also affected by the financial instrument traded:

- Group entities that are EU-regulated have access to leverage of up to 30:1.

- As an Australian company, XM is allowed to offer up to 30:1 leverage.

- 1000:1 leverage is offered by international entities.

Nevertheless, you should always choose your leverage carefully, as well as the entity under which you intend to trade. Through XM's education center, you can learn more.

XM Bonuses

XM Sign-Up Bonus

Bonus is available for XM Global Limited clients only. For further information, please visit the XM website.

XM Minimum Deposit Bonus

The minimum deposit amount required to open an XM trading account ranges from $5– $10,000. XM offers four trading accounts: the Micro Account, Standard Account, XM Ultra Low Account, and Shares Account.

XM Trading Platforms

PC/MAC, Smartphones, and tablets are all supported by XM's MetaTrader suite.

MetaTrader4 and MetaTrader5 are well-known and perfectly-developed trading platforms on which XM clients can make transactions and trades.

Recently, XM launched its "Social Area" platform. With this addition, traders can connect, discuss, and challenge one another. There are competitions on XM's site where traders can compete for prizes and managerial positions. Nerds can mimic expert trades through Copytrade, and the platform fosters global interaction among trading enthusiasts with its community of over 10 million.

There are two major industry platforms for XM - MT4 and MT5. Due to their popularity and widespread use, platforms are clearly beneficial to traders, since they offer a wide range of extensions and comprehensive educational materials. It is always beneficial for brokers to choose platforms that have high ratings because of their international recognition.

Since XM offers MT4 and MT5, XM's platforms are excellent. Aside from comprehensive research, advanced tools, copy trading, robot trading, and expert advisors, the company also developed its own platform.

XM web trading

With a full range of technical analysis, indicators, and comprehensive tools, as well as stop or trailing orders, all platforms are integrated with one account and are available in a variety of versions. XM trading can be accessed by using a web browser and logging into Web Trading.

XM desktop trading platform

With 16 trading platforms, XM's software is even more advanced and suitable for all devices, including web, mobile, and multi-account trading. Using the Desktop platform or other versions makes trading easier and gives you full account functionality.

Due to XM's use of MT4 and its newer version MT5, you can use automated trading or trading robots to benefit from its powerful capabilities. In addition to EAs with unlimited charts, manual trading tools are also available for those who prefer technological trading. This makes them a good fit for a wide variety of traders because they meet all trade needs and requirements and are at a very sustainable level.

XM platform trading tools

Furthermore, we found numerous XM add-ons that allow you to take advantage of the platform's extra features. This includes XM VPS, Rapid Trade Execution, and remote access to a Virtual Private Server (VPS). Without monitoring or computer on, the XM VPS provides non-stop work. Free VPS are available to clients who have a minimum of $5,000 or equivalent. If they cannot meet the requirements, they can still request a tool for $28 per month.

Look and feel

The MetaTrader trading platform is known for its easy-to-use interface and powerful charting capabilities, which make it one of the most popular trading platforms. Its look and functions will appeal to you as well.

Mobile trading platform

Mobile trading is also possible. You can access a trading account with full account functionality through the XM MT4 Android and iOS apps. There are three chart types available in the MT4 and MT5 apps, over 30 technical indicators included, and a complete trading history log.

How to place orders with XM?

With MT4 or MT5, you can also place an order with one click. Market orders and pending orders are available on all platforms. Your strategy should always be adhered to along with your risk tools. The steps for placing an order are as follows:

- To trade a product, select it from Market Watch

- Select "New Order" by right-clicking.

- Under "Type", choose either Pending Order or Market Order.

- With Volume, Stop Loss, Take Profit, you can set levels of risk, reward, and expectation.

- Click on "Place".

- Your order can be adjusted or canceled at any time, as well as closed manually once executed.

XM Market Instruments

With XM, you will be able to choose from an extensive selection of products according to your preferences and expectations. The instrument offering has also grown rapidly over the past few years with more Cryptocurrencies and CFDs being added.

With a multi-asset account, you can trade across over 1000+ trading markets in six asset classes, 55 currency pairs, and six asset classes. Trading Forex or CFDs of stock indices, commodities, stocks, metals, energies, and cryptocurrencies are all available at XM from the same trading platform.

A total of 60 cryptocurrency pairs are offered by the broker under its XMGlobal brand. In the ever-evolving digital currency market, the brand's extensive range is a testament to its commitment to addressing traders' diverse needs.

XM is a stock broker, isn't it?

Stocks are available for trading on XM as well, including both popular and minor stocks. Trading and investing in Real Stocks is not possible because it primarily uses CFDs. Our research showed that XM entities differ in terms of conditions and offerings.

In Europe, the company offers mainly CFDs and Forex instruments; for international clients, there is a much wider selection.

The FSC regulates the trading of CFDs and forex, but the trading of real stocks is only available to clients under the FSC's regulation. It is not possible to invest in popular asset classes such as ETFs, bonds, or options.

A lot of currency pairs are available for trading at XM, a CFD and forex broker. CFD selection is lower than some XM alternatives, however.

| XM | FxPro | Admirals | |

|---|---|---|---|

| Currency pairs (#) | 55 | 70 | 50 |

| Stock index CFDs (#) | 31 | 29 | 40 |

| Stock CFDs (#) | 1,300 | 1,700 | 3,445 |

| Commodity CFDs (#) | 18 | 25 | 28 |

CFDs Trading at XM Disclaimer

Because CFDs are leveraged instruments, there is a high risk of losing money rapidly. Trading CFDs with this provider results in a loss for 75.33% of retail investor accounts. The high risk of wasting your money should be considered before investing in CFDs.

The XM Global Limited entity offers cryptos to its customers.

The leverage levels of the products cannot be changed, which is a drawback. It is very useful to change leverage manually in order to lower trade risk. Trading forex and CFDs can carry a high level of leverage risk, so be careful when doing so.

XM ETFs and real stocks

For clients onboarded through XM's IFSC-regulated entity, real stocks are provided. Shares Accounts are the only way to purchase stocks. Comparatively, it is a big improvement.

| XM | FxPro | Admirals | |

|---|---|---|---|

| Stock markets (#) | 3 | - | 11 |

XM Safety and Security

Cyprus Securities and Exchange Commission (CySEC), Australian Securities and Investments Commission (ASIC), Dubai Financial Services Authority (DFSA) and Financial Services Commission (FSC) regulate XM. More than 10,000,000 clients in 190 countries trust XM's 25+ secure payment methods and Negative Balance Protection.

Is XM safe or scammy?

There is no scam at XM. Since XM is licensed and regulated by several top-tier financial authorities, including FCA, ASIC, and CySEC, we consider XM a safe broker for trading Forex and CFDs. As a result, trading is secure and low-risk.

Regulations and compliance at the XM Group

XM Group operates as Trading Point of Financial Instruments Ltd. as a group of regulated online brokers. It was founded in 2009 and is regulated by the Cyprus Securities and Exchange Commission (CySEC). The Australian Securities and Investments Commission (ASIC) regulates another entity in Australia called Trading Point of Financial Instruments, established in 2015. So it's obvious that regulatory obligations are covered sustainably by XM.

A point to consider is that XM Global Limited is regulated by the Financial Services Commission, enabling it to offer its services worldwide. Although the IFSC is an offshore license, which does not actually monitor trading processes, XM's additional heavy regulation makes it an acceptable choice.

The relevant financial authorities have regulated XM in order to serve users from more than 190 countries. The company is currently licensed by Australia's ASIC, Cyprus' CySEC, Belize's FSC, and Dubai's DFSA. Through these institutions, XM ensures that it remains completely responsible for its customers. Funds belonging to customers must be kept secure as part of the company's obligations. In order to achieve this, funds are stored at Tier 1 banks only.

Reliability & security of XM Group

Regulators aim to protect traders' funds so that they can trade confidently, knowing their funds are secure. The risk of fraud or unfair use is minimized as a result. An important feature of its trading environment is that it complies with regulatory measures, making it an able broker to trade with.

The Investor Compensation Fund also keeps client funds in investment grade banks and uses segregated accounts. Depending on the broker's coverage scheme, funds up to €20,000 can be recovered in case of insolvency. The Negative Balance Protection is another advantage you'll receive as a trader. Therefore, you cannot lose more than your balance.

The platform and execution reliability of XM make it an industry leader. With over 99% of its trades executed in under a second, the company boasts the fastest trading times in the industry. It is easy for them to retrieve quotes or reject orders when they are matched. For professional and retail traders, XM is a trusted name that could prove costly if they make a mistake or experience latency.

The company's operating funds are kept separate from client funds, ensuring fund security. Furthermore, XM's compliance efforts with multiple financial authorities provide additional assurance that it will follow the law on behalf of its users.

XM Customer Support

XM Global covers trading needs while international customer service teams are available. Over 25 languages are spoken by the team, including Chinese, Russian, Hindi, Arabic, Portuguese, Thai, and Tagalog.

You can reach the customer support team 24 hours a day, 7 days a week. Email, phone, and live chat are all ways to reach the broker. Additionally, XM's client-oriented policy is confirmed by its high-quality service and reliable answers.

Customer support is knowledgeable, Live Chat answers are fast, and they are also easy to reach during working hours.

Customers can reach XM's customer service by email, phone, or live chat (available 24/7). XM's customer service is fast and available in many languages. Relevant answers are provided. Weekend phone support is not available, however.

XM can be reached at:

- Live chat.

- Phone.

- Email.

It's easy to get an answer, and it's usually relevant.

During live chat, the first message is answered quickly, but subsequent questions are answered slowly. The same question sometimes had to be asked multiple times before we got a straight answer.

While XM's phone support was fast, we didn't always receive relevant answers. Our question about how swaps are calculated, for example, was not answered clearly. There are days when you get the right answer, and other days when you don't.

The email support works very well. Our questions were answered within a day, and all of them were relevant.

User Experience at XM Group

With MetaTrader, users do not have to learn its proprietary dashboard in order to switch to the standard trading interface. MetaTrader (MT4 or MT5) is the platform used by both web traders and desktop traders.

In spite of MetaTrader's extensive history and ongoing efforts to improve aesthetics and usability, the platform's widespread popularity can be attributed in part to its extensive background serving traders of all levels of experience. With all functionality logically arranged, MetaTrader provides an easy-to-use interface. It includes tools for analyzing, tracking open trades and order histories, and charting. Through the MT5 platform, the XM app (free to download for iOS and Android devices) extends trading functionality on the go. Users can manage their account, research investments, and track their portfolio via the app.

The educational services provided by XM are exceptional. Users can attend free webinars on popular topics on a weekly basis, highlighting the company's commitment to user education. As part of its Live Education service, clients of all levels can participate in Q&A sessions in their own language with expert instructors. Strategies, market movements, and news are discussed during these sessions.

Furthermore, XM provides its traders with basic trading strategies and educational materials. Elementary education is provided through a variety of videos and articles on a variety of topics. Furthermore, traders can keep up-to-date on current market trends through a section dedicated to live market analysis.

XM Education and Training

Through the XM Learning Center, clients can access numerous educational materials in addition to excellent customer service. Trading data and other essential information can be found in these materials. A comprehensive education program has been developed by XM in various regions in order to educate traders. Traders will appreciate this.

You can expect quality learning at XM, regardless of your level. Among these are Live Education, Educational Videos, Forex Webinars, and regular Forex Seminars held at various locations. You can also access tutorials, videos, and tools that are very well organized.

The XM Academy features webinars, excellent trading videos, and comprehensive education materials.

XM offers excellent education. Educative videos and high-quality webinars are available as well as demo accounts and tutorials on trading platforms.

There are several ways to learn at XM:

- A demo account is available.

- Video tutorials for platforms.

- Videos for general education.

- Online webinars.

There are a lot of videos in XM's education section. Various topics can be explored, from introductions to financial markets to money management and trading strategies. XM users have access to several lessons within each chapter.

Additionally, they offer live training online and offline for different levels of experience along with these pre-recorded materials.

XM Research

As far as research tools and market materials are concerned, XM has them in good shape as well. XM also offers Fundamental Analysis and Trade Ideas suitable for beginning and advanced traders, along with News Feeds, Technical Summaries and Technical Analysis.

In XM, you will find everything you need to make smart trading decisions in one place, including Forex Calculators, MQL5 and more. Subscribers can also perform algorithmic trading using proprietary technical indicators available on both platforms.

XM Awards and Recognition

XM's focus on the needs of its clients attracts global traders. Throughout the years, there has been impressive progress for the company and its awards. The company used to receive awards occasionally, but now they are presented on a regular basis. The company has received many reputable awards for industry achievements in addition to its highly successful results and solid reputation within the trading community.

Best FX Customer Service

Best FX Broker, Europe, Australasia, Latin America, and Middle East

Best Customer Support, Global

Best CFD Provider

The Best Crypto CFDs

Best FX Service Provider

Best Customer Support

Best Forex Trading Support

Best FX Educational Broker in the MENA region

Best Trading Experience

Best FX Service Provider

Best Broker in Customer Service

Best Customer Service Experience – Global

Best FX Service Provider

Best Customer Service Global and Best Market Research and Education

Best FX Service Provider

Best Forex Customer Service

Best Market Research & Education

Best Trading Support

Best FX Service Provider

Best Local Customer Service

Fastest Growing Broker MENA

Best FX Technology Provider

Best FX Technology Provider

Best FX Technology Provider

XM Final Thoughts

XM can be summarized as a trustworthy broker regulated by one tier-2 regulator and one tier-3 regulator. With openness to cultural, national, ethnic, and religious diversity, XM is a worthwhile company for potential traders, retail traders, experienced traders, and professional traders.

Via its high compatibility with MetaTrader 4 and 5, XM is one of the most reliable trading platforms available. Although ETFs cannot be traded on XM, there are still many assets available to investors. This website offers comprehensive educational tools for traders of all levels of experience. Also, the XM team is ready to answer any questions promptly in the correct language, since the support team is available seven days a week (24/5 for EU-regulated entities). The most significant value-added benefits of XM come from its accuracy and cost-efficiency.

XM delivers transparent conditions, has numerous highly respected licenses, and is extremely customer-friendly. There are no re-requotes and no hidden fees or commissions, along with negative balance protection. We had very comfortable and efficient real-time market execution with XM, making it a great choice for beginners as well as small accounts.

Thus, based on the costs, trading conditions and opportunities offered by XM, we conclude they offer one of the most comfortable propositions. Previously, the broker offered a much smaller range of trading instruments, but now it is one of its strongest points.

XM is appropriate for:

- Beginning traders.

- MT4 and MT5 traders.

- Currency trading and CFD trading.

- Trading investors.

- Suitable for many trading strategies.

- Long-term trading.

- Professional trading.

- Forex education.

- Trading with low deposit requirements.

Latest XM Posts

MyFxBots Admin

[Last Modified On Tues, 3 Oct 2023]Talk about XM

Information, charts or examples contained in this review article are for illustration and educational purposes only. It should not be considered as an advice or endorsement to purchase or sell any security or financial instrument. We do not and cannot give any kind of financial advice. No employee or persons associated with us are registered or authorized to give financial advice. We do not trade on anyone's behalf, and we do not recommend any broker. On certain occasions, we have a material link to the product or service mentioned in the article. This may be in the form of compensation or remuneration.

-

Social & Feed

- @myfxbots

- @myfxbots.Expert.Advisors

- @myfxbots.expert.advisors

- @myfxbots.expert.advisors

- @myfxbots_eas

- @myfxbots

- @myfxbots

- @myfxbots

- @myfxbots

- @myfxbots

Tags

Forex Combo System WallStreet Forex Robot 3.0 Domination Omega Trend Broker Arbitrage FX-Builder Forex Diamond Volatility Factor Pro GPS Forex Robot Tick Data Suite Vortex Trader PRO Forex Trend Detector Swing Trader PRO RayBOT Forex Gold Investor FXCharger Best Free Scalper Pro Gold Scalper PRO News Scope EA PRO Smart Scalper PRO FX Scalper Evening Scalper PRO Waka Waka Golden Pickaxe Perceptrader AI Happy Bitcoin Algocrat AI Traders Academy Club Quant Analyzer AlgoWizard Quant Data Manager FXAutomater InstaForex RoboForex IronFX Tickmill FXVM Alpari FX Choice TradingFX VPS Commercial Network Services VPS Forex Trader QHoster GrandCapital IC Markets FBS FX Secret Club StrategyQuant X Happy Forex LeapFX Trading Academy ForexTime Magnetic Exchange BlackBull Markets ForexSignals.com Libertex AMarkets HFM Broker FxPro Binance ACY Securities IV Markets Forex VPS MTeletool Forex Store Valery Trading Telegram Signal Copier Telegram Copier Forex Robot Academy Forex Robot Factory (Expert Advisor Generator) SMRT Algo EGPForex

Risk

Forex trading can involve the risk of loss beyond your initial deposit. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Forex accounts typically offer various degrees of leverage and their elevated profit potential is counterbalanced by an equally high level of risk. You should never risk more than you are prepared to lose and you should carefully take into consideration your trading experience.

Past performance and simulated results are not necessarily indicative of future performance. All the content on this site represents the sole opinion of the author and does not constitute an express recommendation to purchase any of the products described in its pages.