The most attractive criterion for traders of Forex compared to other financial instruments is that it can give them much higher leverage than what stocks could give. While the term "leverage" is not an uncommon word, few recognize its meaning, how it works, and how it can directly impact their final results.

Forex markets can also handle the concept of using other people's money to enter a transaction, a process that has benefits but employing leverage in a Forex trading strategy can also be dangerous, and this is what we shall discuss today.

- Leverage is increasing the trading position of a trader over his own cash balance alone using borrowed funds.

- Brokerage accounts allow applying leverage via margin trading by providing the borrowed funds by the account holding broker.

- Leverage is often used by traders to profit from relatively small price changes in currency pairs.

- As leverage can amplify profits, it also can amplify losses.

Leverage Definition

Leverage means borrowing an amount of money to invest in something, in Forex, the borrow source is usually a broker. Forex trading allows high leverage so that for an initial margin requirement, a trader can obtain — and manage — a huge amount of money.

Margin-based leverage can be calculated by dividing the total transaction value by the amount of margin required for the trader to set up:

For example, if a trader is required to deposit 1% of the total transaction value as a margin and intends to trade one standard lot of EURUSD, which is equivalent to $100,000, the margin required would be $1,000. Thus, his margin-based leverage will be 100:1 (100,000/1,000). Using the same formula, for a margin requirement of just 0.25%, the margin-based leverage will be 400:1.

However, the real leverage is different from the margin-based leverage in that it is a stronger indicator of profit and loss while the margin-based leverage does not necessarily affect risk as the investor can always attribute more than the required margin for any position, so whether he is required to put up 1% or 2% of the transaction value as margin may not influence his profits or losses.

the real leverage currently being used can be simply calculated by dividing the total face value of the trader's open positions by your trading capital:

Real Leverage = Total Value of Transaction / Total Trading Capital

For example, if a trader has $20,000 in his account, and opens a $100,000 position (one standard lot), he will be trading with 5 times leverage on his account (100,000/20,000). If he trades two standard lots, which are worth $300,000 in face value with $20,000 in his account, then his leverage on the account is 15 times (300,000/20,000).

In other words, the margin-based leverage is equal to the maximum real leverage a trader is able to use. As almost no trader uses his entire account balance as a margin for each of his trades, his real leverage is always different from his margin-based leverage.

Generally, a trader should not use all of his available margin, and should only use the leverage when its advantage is obviously on his side.

The potential loss of capital which should never exceed 3% of the trading capital, can be measured once the amount of risk in pips number is known. To explain this point, if a position is leveraged to a point with which the potential loss has reached for example 20% of the trading capital, the leverage should then be decreased by this measure.

However, experienced traders over time gain their own risk parameters and may voluntarily deviate from this general guideline of 3%, they may also calculate the level of margin that they need to use. For example, if a trader has an account with a balance of $20,000 and decided to trade 5 mini EURGBP lots, each move of one pip in a mini account is worth about $1, but 10 pips in such account are worth about $10, however, 100 minis mean that each pip move is worth about $100.

So, a stop-loss of 40 pips means a potential loss of $40 for a single mini lot, $400 for 10 mini lots, or $4,000 for 100 mini lots. Therefore, with a $20,000 account and a 3% maximum risk per trade, a trader should leverage only up to 60 mini lots even though he may be able to trade more.

Leverage in Forex Trading

In Forex, leverage can reach as high as 100:1, so that the Forex trader can trade up to $100,000 in value for every $1,000 in his account. Leverage is a function of risk, that's the cause many traders believe to be for such high leverage offered by Forex market makers, which means that if the account is properly managed, the risk will also be very manageable, otherwise, they would not offer the leverage. Another cause of such high leverage in the Forex market is its large and liquid spot cash which gives it an advantage over other less liquid markets.

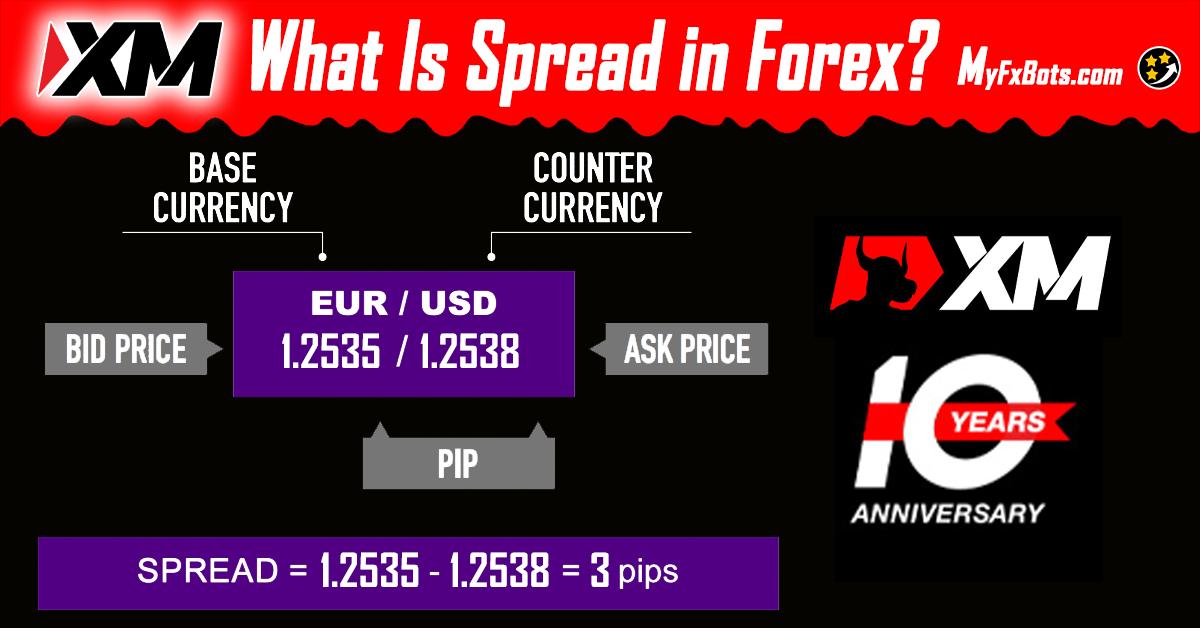

The currency price movements in Forex are measured in pips, the smallest unit in a currency price change which is really just a fraction of a cent, and depend on the currency pair. For example, when a currency pair like the USDJPY moves 100 pips from 1.8700 to 1.8800 — that is, just a 1 cent move of the exchange rate.

So that carrying out currency transactions in sizable amounts, allows these tiny price movements to result in larger profits when amplified by leverage. When a trader deals with an amount like $100,000, the currency price small changes can make significant profits or losses.

Risk of Forex Trading with Excessive Real Leverage

As profits or losses are increased in parallel with the increase in real leverage. The greater the amount of leverage applied on capital, the higher the risk assumed, which is not necessarily related to margin-based leverage although it might influence in a few careless situations.

Assuming two traders; A, and B, each of whom has a trading capital of US$10,000, and they trade with a broker that requires a margin deposit of 1%. After price monitoring, they believed that GBPUSD's price is on its way to dropping in value from a high top, and they both opened short positions of USDJPY at 120.

Based on his trading capital, trader A chose to apply 50 times real leverage and opened a short position of $500,000 (50 x $10,000) USDJPY. One pip of USDJPY for one standard lot is worth about $8.30 as the currency pair stands at 120, so one pip of USDJPY for five standard lots is worth about $41.50. USDJPY price rise to 121 will lead trader A to lose 100 pips ($4,150) on this trade which represents 41.5% of his total trading capital.

However, trader B is more careful and decided to apply five times real leverage and opened a short position of $50,000 (5 x $10,000) USDJPY based on his trading capital which equals just one-half of one standard lot. USDJPY price rise to 121 will lead trader B to lose 100 pips ($415) on this trade which represents 4.15% of his total trading capital.

Forex Margin in Comparison with Stock Trading

Leverage in the forex markets is usually much larger than the 2:1 leverage provided in equities commonly and even the 15:1 leverage provided in the futures market. 100:1 leverage seems to be extremely risky, but that risk is effectively lowered as the currency prices usually change by less than 1% during intraday trading (while trading within one day).

Volatility is not a major criterion of Forex Markets

Forex markets are one of the most liquid markets in the world, so they are less volatile than other markets like real estate. Multiple factors contribute to form the volatility of a particular currency, the politics, and the economics of its country are important ones. For example, events like economic instability in the form of a payment default or imbalance in trading relationships with another currency can result in significant volatility.

The most suitable Leverage in Forex trading

Traders' comfort is the key. For conservative traders who don’t like taking many risks, or those still learning the ways of currency trading, a lower level of leverage like 5:1 or 10:1 might be more appropriate. More seasoned or risk-tolerant traders may be comfortable with 50:1 or 100:1+.

The Bottom Line

If you've well learned, and recognized how to manage it, you shouldn't be afraid of leverage. Taking an away-from-keyboard approach to your trades is the only case where you should never use leverage. Otherwise, leverage can be used successfully and profitably with proper management. In any case, it should be handled carefully.

Applying smaller amounts of real leverage to each trade creates a comfortable range where you can easily set a wider but reasonable stop and avoid higher losses of capital. If it goes against you, a highly leveraged trade can easily vanish off your trading account as the bigger lot sizes will make the losses greater too. Always remember that leverage is fully flexible and customizable according to each trader's needs.

Latest XM Posts

MyFxBots Admin

[Last Modified On Mon, 13 Jun 2022]MyFxBots Admin

[Last Modified On Mon, 13 Jun 2022]Talk about XM

Information, charts or examples contained in this blog post are for illustration and educational purposes only. It should not be considered as an advice or endorsement to purchase or sell any security or financial instrument. We do not and cannot give any kind of financial advice. No employee or persons associated with us are registered or authorized to give financial advice. We do not trade on anyone's behalf, and we do not recommend any broker. On certain occasions, we have a material link to the product or service mentioned in the article. This may be in the form of compensation or remuneration.

-

Social & Feed

- @myfxbots

- @myfxbots.Expert.Advisors

- @myfxbots.expert.advisors

- @myfxbots.expert.advisors

- @myfxbots_eas

- @myfxbots

- @myfxbots

- @myfxbots

- @myfxbots

- @myfxbots

Tags

Forex Combo System WallStreet Forex Robot 3.0 Domination Omega Trend Broker Arbitrage FX-Builder Forex Diamond Volatility Factor Pro GPS Forex Robot Tick Data Suite Vortex Trader PRO Forex Trend Detector Swing Trader PRO RayBOT Forex Gold Investor FXCharger Best Free Scalper Pro Gold Scalper PRO News Scope EA PRO Smart Scalper PRO FX Scalper Evening Scalper PRO Waka Waka Golden Pickaxe Perceptrader AI Happy Bitcoin Algocrat AI Traders Academy Club Quant Analyzer AlgoWizard Quant Data Manager FXAutomater InstaForex RoboForex IronFX Tickmill FXVM Alpari FX Choice TradingFX VPS Commercial Network Services VPS Forex Trader QHoster GrandCapital IC Markets FBS FX Secret Club StrategyQuant X Happy Forex LeapFX Trading Academy ForexTime Magnetic Exchange BlackBull Markets ForexSignals.com Libertex AMarkets HFM Broker FxPro Binance ACY Securities IV Markets Forex VPS MTeletool Forex Store Valery Trading Telegram Signal Copier Telegram Copier Forex Robot Academy Forex Robot Factory (Expert Advisor Generator) SMRT Algo EGPForex

Risk

Forex trading can involve the risk of loss beyond your initial deposit. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Forex accounts typically offer various degrees of leverage and their elevated profit potential is counterbalanced by an equally high level of risk. You should never risk more than you are prepared to lose and you should carefully take into consideration your trading experience.

Past performance and simulated results are not necessarily indicative of future performance. All the content on this site represents the sole opinion of the author and does not constitute an express recommendation to purchase any of the products described in its pages.