When it comes to trading stocks, there are a few different options out there. You can trade them through the Forex market, or you can trade them through the traditional stock market.

Each option has its own set of pros and cons, which we will discuss in this blog post. So, which is the best way to trade stocks? Let's take a look!

What is Forex Trading?

Forex trading is the act of buying and selling currencies. The foreign exchange market is the place where these trades take place. It is the largest and most liquid market in the world.

There are a variety of different factors that can affect the value of a currency, such as economic indicators, political events, and more. Traders attempt to make money by buying currencies when they are low and selling them when they are high.

Pros and Cons of Forex Trading

There are a few pros and cons of Forex trading that you should be aware of before getting started.

PROS:

-

The foreign exchange market is the largest in the world, so there is a lot of liquidity. This means that there are always buyers and sellers, so you can trade your currency anytime you want.

-

It is a very accessible market. All you need is an internet connection and a computer or mobile device. You can trade from anywhere in the world.

-

Since the Forex market is open 24 hours a day, from Monday to Friday, you can trade whenever you want, even if it is in the middle of the night.

-

There is a lot of leverage available in the Forex market. Leverage is when you borrow money from your broker to trade with. This can help you make bigger profits, but it can also lead to bigger losses.

-

You can trade a variety of different currencies in the Forex market. This means that you can diversify your portfolio and reduce your risk.

CONS:

-

The Forex market is very volatile. This means that the prices of currencies can change very quickly, and it can be difficult to predict what will happen next.

-

It can be a risky market to trade-in. If you don't know what you are doing, you could lose all of your money.

-

Although there is a lot of leverage available in the Forex market that can help you make bigger profits, it can also lead to bigger losses.

-

The Forex market is decentralized, which means that there is no one place where all of the trading takes place. This can make it difficult to find information and make decisions.

So, those are a few of the pros and cons of Forex trading. As you can see, it is a very accessible market, but it is also very volatile. It is important to do your research before getting started so that you know what you are doing.

Now let's take a look at the traditional stock market.

What is the Traditional Stock Market?

A traditional stock market is a place where stocks and other securities are bought and sold. It is a central exchange where all of the trading takes place. The most famous stock market in the world is the New York Stock Exchange.

Pros and Cons of the Traditional Stock Market

Now let's take a look at the pros and cons of the traditional stock market.

PROS:

-

The traditional stock market is much less volatile than the Forex market. This means that it is easier to predict what will happen and make money.

-

It is a very regulated market. This means that there are rules that everyone has to follow. This makes it a safer place to trade.

-

The traditional stock market is centralized. This means that all of the trading takes place in one place, making it easier to find information and make decisions.

CONS:

-

The traditional stock market is not open 24 hours a day. You can only trade during business hours, from Monday to Friday.

-

Since it is a very regulated market, it can be difficult to get started. You have to follow a lot of rules and there’s a lot of paperwork.

-

The traditional stock market is centralized, which makes it difficult to find information and make decisions.

Forex Trading vs. Traditional Stock Market Trading: Which is Better?

When it comes to Forex trading vs. traditional stock market trading, there is no clear winner. It depends on your individual needs and goals.

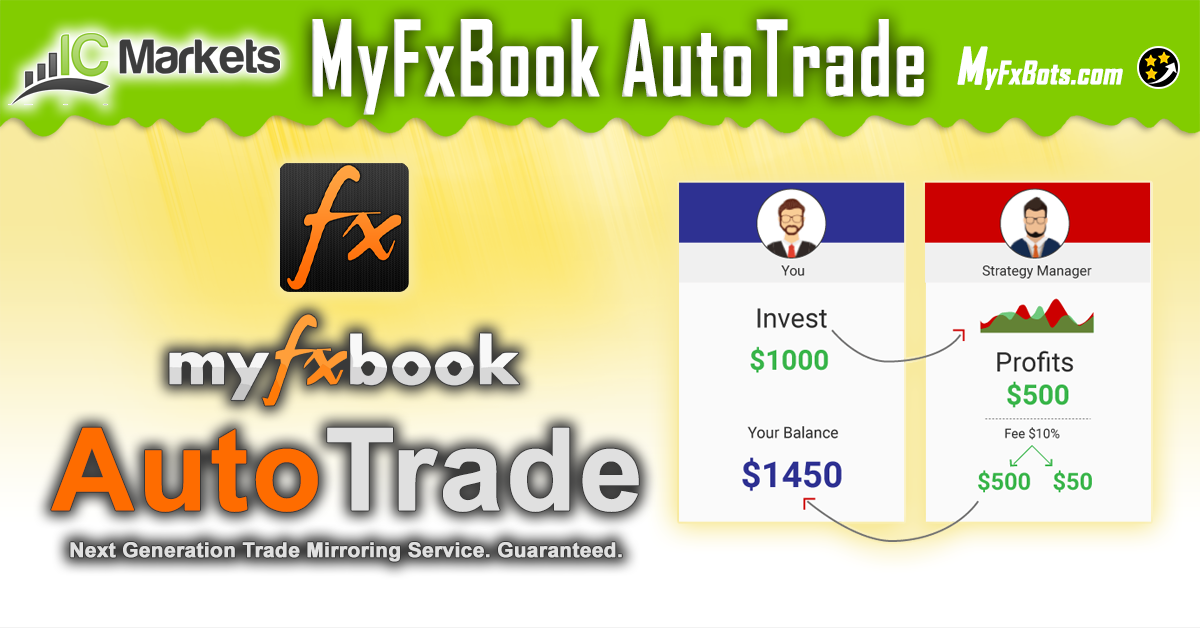

But when doing trading, there are some things you need to consider aside from its pros and cons, including the fees involved in each type of trading.

When you trade stocks through the Forex market, you will typically have to pay a commission to the broker. This commission can vary depending on the broker that you use, but it is usually around $20 per trade. When you trade through the stock market, you will not have to pay any commissions. This is because the stock market is regulated by the government, and they take a cut of the profits that are made. So, if you are looking to save on fees, then you may want to consider trading through the stock market.

Also, when doing Forex trading, you need to have an understanding of the margin of safety. The margin-of-safety formula is used to calculate the risk involved in any given trade. When you are trading stocks through the Forex market, you are essentially borrowing money from the broker in order to make your trades. This means that your margin of safety is much lower than it would be if you were trading through the stock market. This is because the stock market is a much more stable environment, and there is less chance that your trade will go sour. However, this also means that your potential profits are much higher in the Forex market. So, it really depends on how much risk you are willing to take.

At the end of the day, it's up to you to decide which one is right for you. Whichever you choose, make sure that you do your research and understand what you are doing before you get started.

Latest IC Markets Posts

MyFxBots Admin

[Last Modified On Sat, 9 Jul 2022]MyFxBots Admin

[Last Modified On Sat, 9 Jul 2022]Talk about IC Markets

Information, charts or examples contained in this blog post are for illustration and educational purposes only. It should not be considered as an advice or endorsement to purchase or sell any security or financial instrument. We do not and cannot give any kind of financial advice. No employee or persons associated with us are registered or authorized to give financial advice. We do not trade on anyone's behalf, and we do not recommend any broker. On certain occasions, we have a material link to the product or service mentioned in the article. This may be in the form of compensation or remuneration.

-

Social & Feed

- @myfxbots

- @myfxbots.Expert.Advisors

- @myfxbots.expert.advisors

- @myfxbots.expert.advisors

- @myfxbots_eas

- @myfxbots

- @myfxbots

- @myfxbots

- @myfxbots

- @myfxbots

Tags

Forex Combo System WallStreet Forex Robot 3.0 Domination Omega Trend Broker Arbitrage FX-Builder Forex Diamond Volatility Factor Pro GPS Forex Robot Tick Data Suite Vortex Trader PRO Forex Trend Detector Swing Trader PRO RayBOT Forex Gold Investor FXCharger Best Free Scalper Pro Gold Scalper PRO News Scope EA PRO Smart Scalper PRO FX Scalper Evening Scalper PRO Waka Waka Golden Pickaxe Perceptrader AI Happy Bitcoin Algocrat AI Traders Academy Club Quant Analyzer AlgoWizard Quant Data Manager FXAutomater InstaForex RoboForex IronFX Tickmill FXVM Alpari FX Choice TradingFX VPS Commercial Network Services VPS Forex Trader QHoster GrandCapital FBS FX Secret Club StrategyQuant X Happy Forex LeapFX Trading Academy ForexTime Magnetic Exchange XM BlackBull Markets ForexSignals.com Libertex AMarkets HFM Broker FxPro Binance ACY Securities IV Markets Forex VPS MTeletool Forex Store Valery Trading Telegram Signal Copier Telegram Copier Forex Robot Academy Forex Robot Factory (Expert Advisor Generator) SMRT Algo EGPForex

Risk

Forex trading can involve the risk of loss beyond your initial deposit. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Forex accounts typically offer various degrees of leverage and their elevated profit potential is counterbalanced by an equally high level of risk. You should never risk more than you are prepared to lose and you should carefully take into consideration your trading experience.

Past performance and simulated results are not necessarily indicative of future performance. All the content on this site represents the sole opinion of the author and does not constitute an express recommendation to purchase any of the products described in its pages.