Every once in a while, I write posts about risk management and how to use it correctly. However, my previous posts were rather short. This time, I would like to dive deeper into this topic and cover everything essential about it in relation to Waka Waka and pretty much all other grid systems.

-

Money management

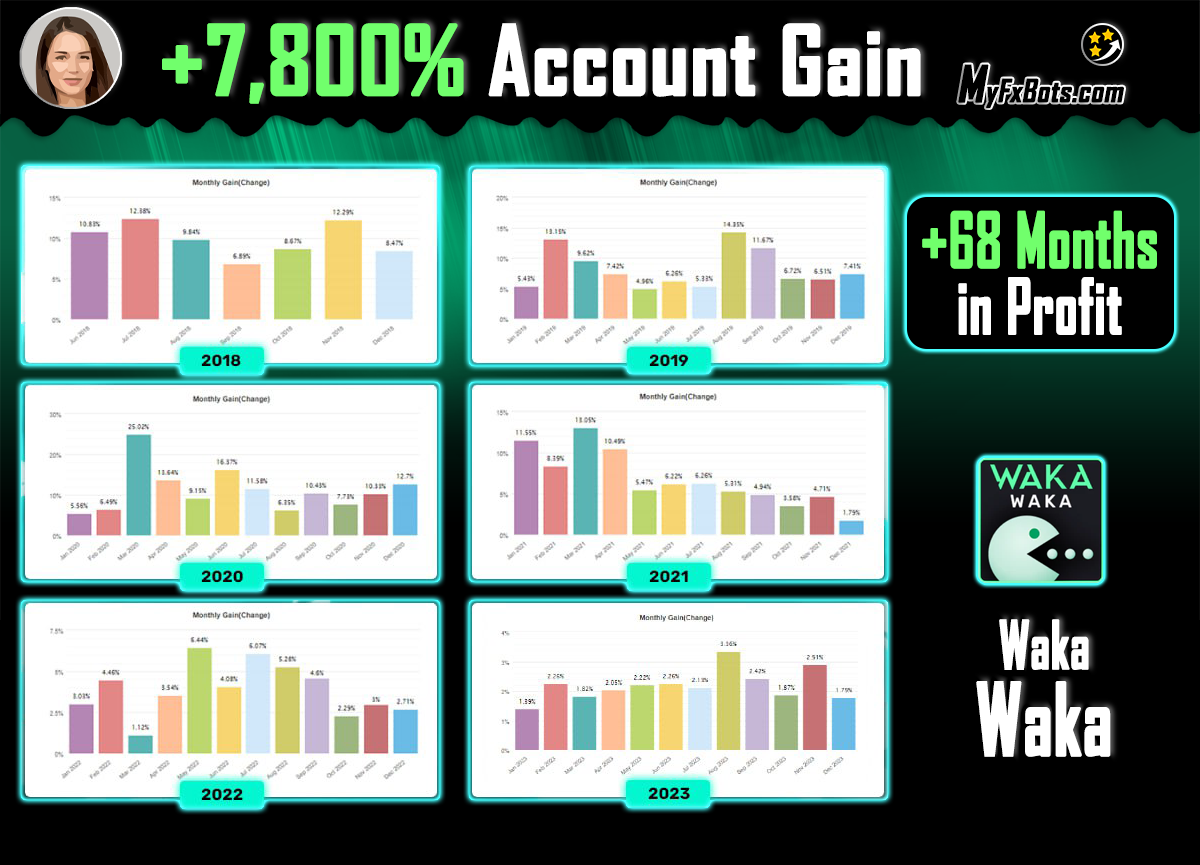

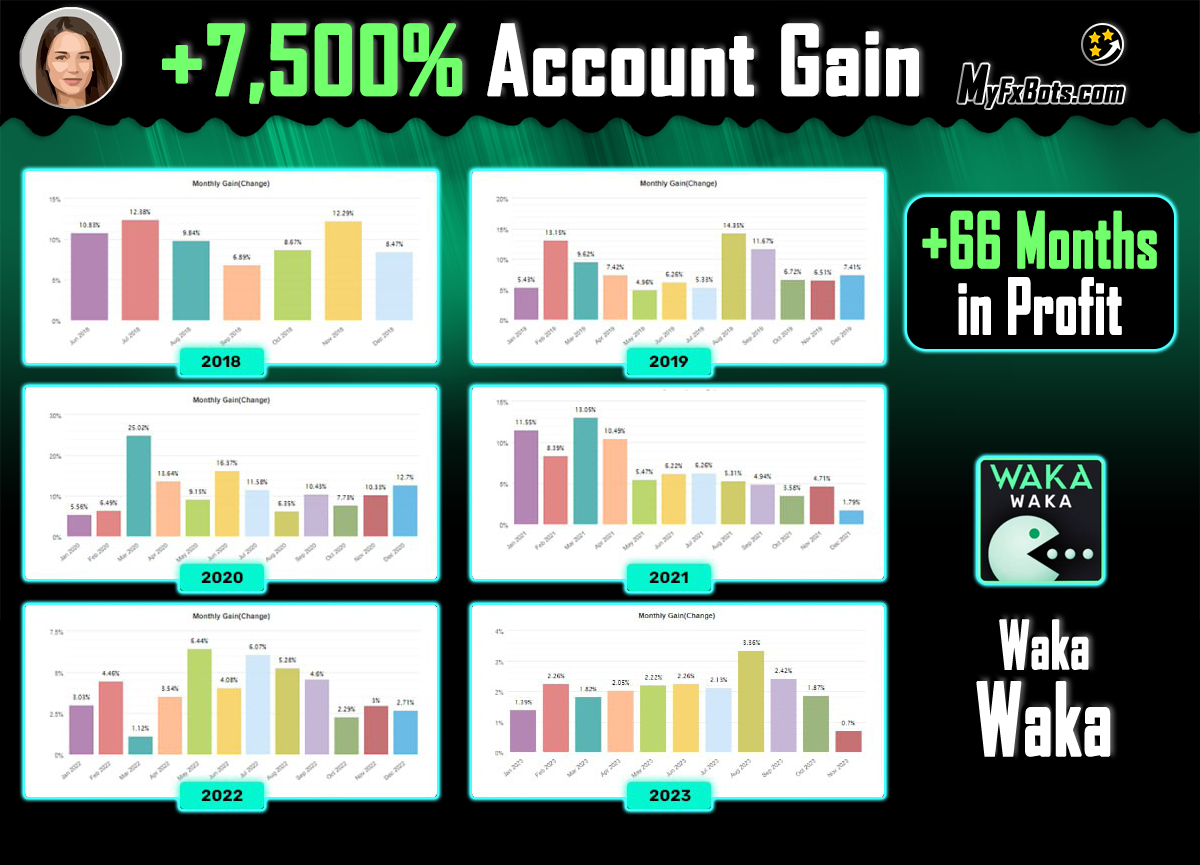

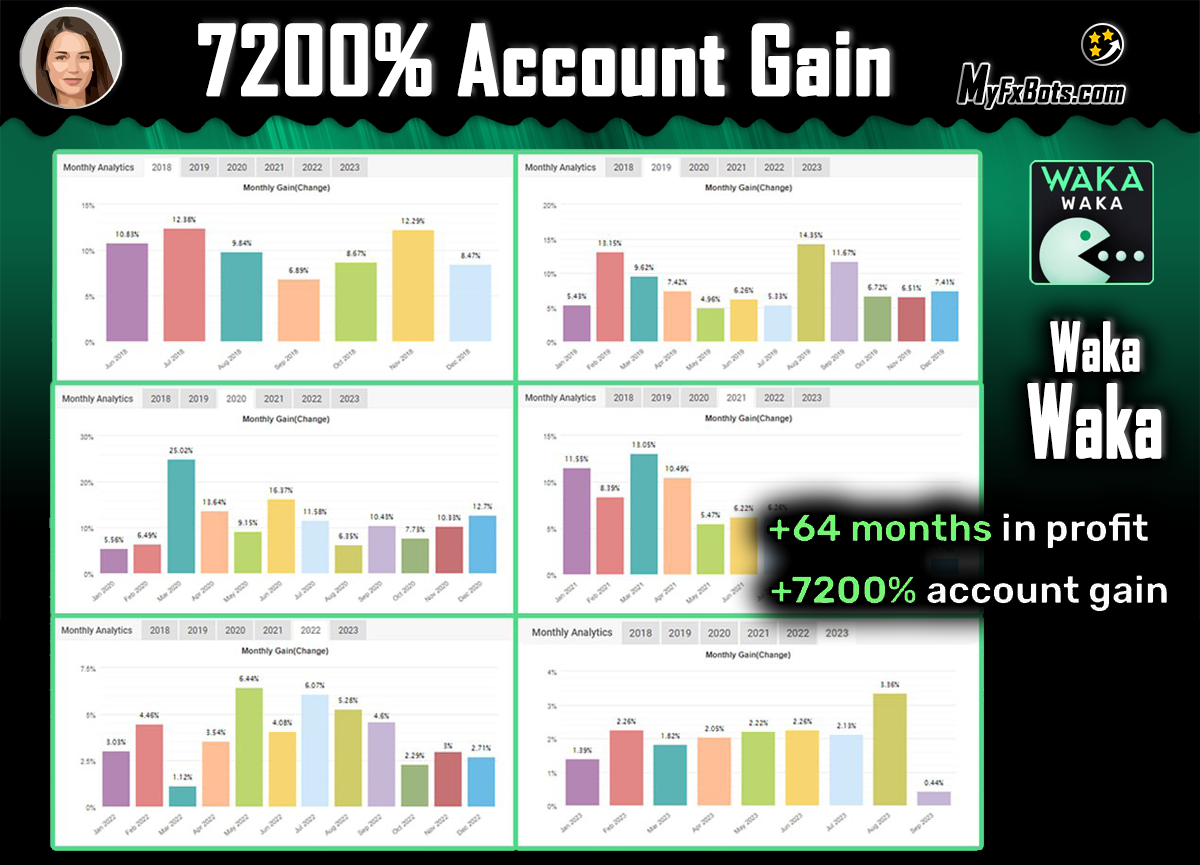

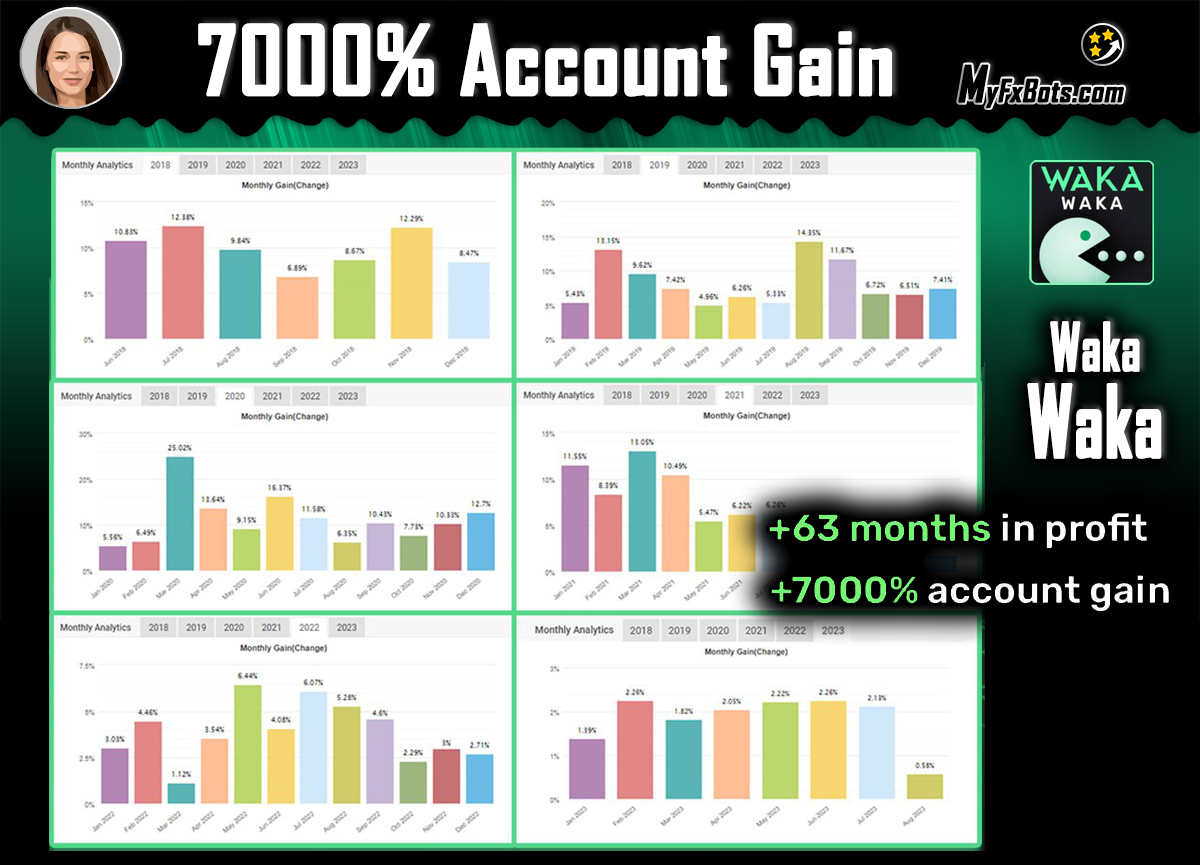

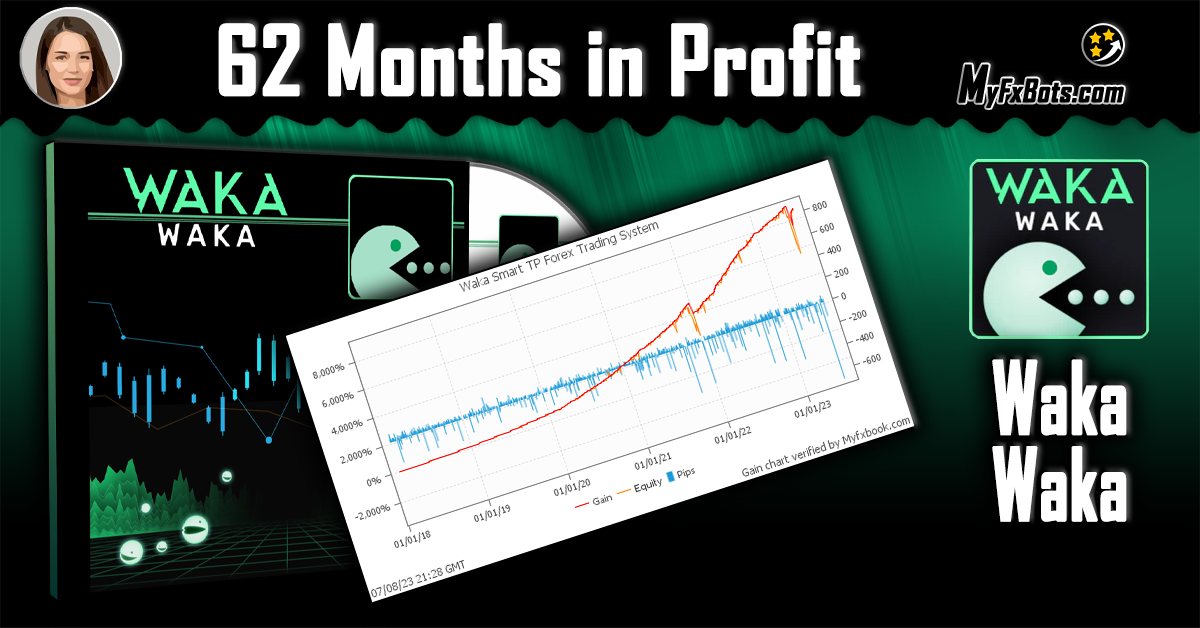

The first thing I always start with is money management. Simply put, it's how big the lot size you want to open in relation to your deposit size. In Waka Waka and Golden Pickaxe, it's regulated by the 'Lot-sizing Method' parameter and others related to it. In most cases, it's enough to choose one of the predefined risk levels from low to high in this parameter, and that's it. That's all money management most people will need. You can see how Valeriia Mishchenko's EAs performed with each risk level in their guides. For example, p. 57 of the Waka Waka guide shows high-quality test results of Waka Waka using 2 different quotes sources for many years.

-

Risk management

To keep it short, that's how the EA deals with drawdowns. In most cases, it's enough to use the simplest 'Max Floating Drawdown %' option. For example, if you set it to 30, the EA will close all trades in case of reaching a 30% drawdown, securing the remaining 70% of the account. However, this parameter is connected with money management. If you set too tight of a drawdown limitation with a high-risk level, it'll frequently be triggered during the normal work of the EA, interfering with its trading. E.g., it doesn't make sense to choose high risk and set the maximum drawdown at 5%. That'll make you bump into this drawdown limitation time and time again, ultimately meaning losses. I usually recommend setting this value above the maximum drawdown seen in the tester. If you can't test the EA properly yourself, I have already compiled long-term test results in guides, as mentioned previously.

-

Default parameters

People frequently ask about what settings of the EA should they use. The answer is that the default settings should be the best in most cases. This sounds boring, but profitable professional trading and investments are always boring. There's a saying about that attributed to Warren Buffet: 'Beware the investment activity that produces applause; the great moves are usually greeted by yawn's'. If you are bored with trading and investments, it usually means you are on the right track. There are plenty of variables in Valeriia Mishchenko's EAs that change results significantly: from core parameters of the system (how to choose an entry), to exit parameters (TP level) and grid settings (coefficients and grid spacing). What some people don't understand is that default values are not chosen randomly. They are a result of careful market research aimed at identifying market reversal levels. Default parameters of the EA work together with the aim of exploiting existing market reversals on the pairs it trades. If you change an entry-level, TP value, or grid setting, you might interfere with this logic. For example, if you make the TP value larger, the EA will exit trades later, and the reversal level might not be enough to close trades and get out of a trending movement. If you change grid coefficients to, let's say, 1-1-1 (so that all orders have the same lot size), you will interfere with the trading logic, making it much more difficult for the EA to get out of the grid. Of course, if you are a professional trader, you know it very well and may ignore this recommendation. But if that's the case, this whole post is just 2x2=4 for you, and you won't find it particularly useful. If you found something new or interesting in it, chances are, default parameters are better for you.

-

Make sure your money management is in line with your deposit size and account leverage

By definition, one can't use high risks with a 1:30 account leverage. The same goes for $100 – it's impossible to use low risks with a small deposit size. You can find historical values and deposit size recommendations in the same table in the guides of Valeriia Mishchenko's EAs.

-

Make sure your VPS works 24/5

If the EA entered a position, then your VPS went offline for a day or two and was not in the market to catch a reversal, which may bring losses to you. Make sure your VPS is stable and also put the terminal in the startup folder of your system. In this case, if your VPS is restarted (which happens every once in a while with any server), the terminal will get back online as soon as the server gets up and running.

-

And the last suggestion – take it seriously and plan ahead

What you might not have understood when reading the post is that each example I have outlined above is real. There were users of Valeriia Mishchenko's EAs who used high risks with a tight drawdown limitation at 5%, there were users who changed grid coefficients, some used the EA with a small deposit and high risk on a 1:30 leverage account, and so on. And each of these examples meant losses. Each of these rules meant someone lost real money. There is a saying in the health and safety industry that all safety regulations are written in blood. It's true, and the same goes for the rules outlined in this post. Each of them is written with losses of traders. It's smart to take all of them into account and trade accordingly, with strict risk and money management in place.

I hope this post is not too long for you to just skip it if it may be useful for you. I highly recommend reading it if you use any grid system from any developer.

Latest Waka Waka Posts

MyFxBots Admin

[Last Modified On Mon, 10 Jul 2023]Other Valery Trading Forex Robots

Evening Scalper PRO

Evening Scalper PRO uses an original & compelling trading logic on cross pairs that have a solid mean-reverting tendency with high-profit targets (unlike most night scalpers).

Night Hunter PRO

Night Hunter PRO utilizes smart entry/exit algorithms to identify only the safest entry points during calm periods of the

market.

Golden Pickaxe

The highest-performing gold EAs all share the same common logic: grid trading.

Valery Trading EA developers team have developed the #1 ranked grid trading EA, called Waka Waka, and then they have applied many of the algorithmic principles from Waka Waka to this gold EA, and the results have been mind-blowing: Golden Pickaxe performs even better than Waka Waka.

Perceptrader AI

Perceptrader AI is a cutting-edge grid trading system that leverages the power of Artificial Intelligence, utilizing Deep Learning algorithms and Artificial Neural Networks (ANN) to analyze big amounts of market data at a high speed and detect high-potential trading opportunities to exploit.

News Catcher PRO

Investing in intraday seasonal volatility patterns driven by news events is the goal of News Catcher PRO, which is a sophisticated mean-reversion trading strategy.

News Catcher PRO does not use martingale or grid by default (optional grid is available).

Talk about Waka Waka

Information, charts or examples contained in this blog post are for illustration and educational purposes only. It should not be considered as an advice or endorsement to purchase or sell any security or financial instrument. We do not and cannot give any kind of financial advice. No employee or persons associated with us are registered or authorized to give financial advice. We do not trade on anyone's behalf, and we do not recommend any broker. On certain occasions, we have a material link to the product or service mentioned in the article. This may be in the form of compensation or remuneration.

-

Social & Feed

- @myfxbots

- @myfxbots.Expert.Advisors

- @myfxbots.expert.advisors

- @myfxbots.expert.advisors

- @myfxbots_eas

- @myfxbots

- @myfxbots

- @myfxbots

- @myfxbots

- @myfxbots

Tags

Forex Combo System WallStreet Forex Robot 3.0 Domination Omega Trend Broker Arbitrage FX-Builder Forex Diamond Volatility Factor Pro GPS Forex Robot Tick Data Suite Vortex Trader PRO Forex Trend Detector Swing Trader PRO RayBOT Forex Gold Investor FXCharger Best Free Scalper Pro Gold Scalper PRO News Scope EA PRO Smart Scalper PRO FX Scalper Evening Scalper PRO Golden Pickaxe Perceptrader AI Happy Bitcoin Algocrat AI Traders Academy Club Quant Analyzer AlgoWizard Quant Data Manager FXAutomater InstaForex RoboForex IronFX Tickmill FXVM Alpari FX Choice TradingFX VPS Commercial Network Services VPS Forex Trader QHoster GrandCapital IC Markets FBS FX Secret Club StrategyQuant X Happy Forex LeapFX Trading Academy ForexTime Magnetic Exchange XM BlackBull Markets ForexSignals.com Libertex AMarkets HFM Broker FxPro Binance ACY Securities IV Markets Forex VPS MTeletool Forex Store Valery Trading Telegram Signal Copier Telegram Copier Forex Robot Academy Forex Robot Factory (Expert Advisor Generator) SMRT Algo EGPForex

Risk

Forex trading can involve the risk of loss beyond your initial deposit. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Forex accounts typically offer various degrees of leverage and their elevated profit potential is counterbalanced by an equally high level of risk. You should never risk more than you are prepared to lose and you should carefully take into consideration your trading experience.

Past performance and simulated results are not necessarily indicative of future performance. All the content on this site represents the sole opinion of the author and does not constitute an express recommendation to purchase any of the products described in its pages.