IC Markets Features

Among the best forex and CFD brokers, IC Markets certainly stands out.

There are low forex fees, fast and easy registration process. It is very easy to deposit and withdraw funds, and there are no fees involved too. A section of its website is devoted to education. Comparatively, IC Markets primarily deals with in forex, stock CFDs, crypto, and indices, futures, and bonds CFDs. Furthermore, investors are protected and negative account balances are covered according to IC Markets' legal entity enclosing the account.

Headquartered

Australia (Oceania)Year Founded

2007Broker Type

NDD, and ECN.Regulating Authorities

Prohibited Countries

Islamic Account

Demo Account

Institutional Accounts

Managed Accounts

Minimum Deposit

$200Maximum Leverage

1:500Payment Methods

Trading Platform Types

Operating Systems

Website Languages

Customer Support

24/7IC Markets Pros and Cons

There are many advantages to trading with IC Markets including a wide selection of platforms, including MT4, MT5, and cTrader platforms, as well as free education and 24/7 customer support. This is a favorable choice for various traders as it offers both spread-based and raw spread accounts, as well as various instruments.

Additionally, we found some spreads higher than average for other instruments depending on the entity and is larger via offshore entities.

| PROS | CONS |

|---|---|

|

|

IC Markets Account Types and Features

|

Features |

cTrader Raw Spread Account | Raw Spread Account | Standard Account |

|---|---|---|---|

|

Account Currencies |

AUD, USD, EUR, GBP, SGD, JPY, CHF, NZD, CAD, HKD |

AUD, USD, EUR, GBP, SGD, JPY, CHF, NZD, CAD, HKD |

AUD, USD, EUR, GBP, SGD, JPY, CHF, NZD, CAD, HKD |

|

Available Leverage |

1:1000 |

1:1000 |

1:1000 |

|

Minimum Deposit |

$200 |

$200 |

$200 |

|

Starting Spreads |

0.0 pips |

0.0 pips |

1.0 pip |

|

Commission Per Trade |

$3.00 |

$3.50 |

None |

|

Decimal Pricing |

Up to 5 |

Up to 5 |

Up to 5 |

|

Trading Instruments |

Foreign Exchange, Commodities, Indices, Shares, Bonds, Futures, Cryptocurrencies |

Foreign Exchange, Commodities, Indices, Shares, Bonds, Futures, Cryptocurrencies |

Foreign Exchange, Commodities, Indices, Shares, Bonds, Futures, Cryptocurrencies |

|

Min. Lot Size Per Trade |

0.01 |

0.01 |

0.01 |

|

Max Lot Size Per Trade |

200 |

200 |

200 |

|

Demo Account |

Yes |

Yes |

Yes |

|

Swap/Rollover Free Option |

Swap-free Islamic Account |

Swap-free Islamic Account |

Swap-free Islamic Account |

|

Copy Trading Support |

Yes |

Yes |

Yes |

IC Markets demo account

The broker offers a risk-free demo account on both MT4 and cTrader, which allows you to practice your trading strategies. A multilingual customer support team offers multilingual support and the demo accounts are available in multiple currencies, up to ten. IC Markets also offers Swap-free and Islamic accounts for traders who follow Sharia rules.

IC Markets Deposit & Withdrawal

Deposits and withdrawals at IC Markets are excellent, with many options available, most of which are free. Unfortunately, withdrawals are only possible in the same way as depositing.

A range of flexible depositing options are offered by IC Markets in a variety of currencies: AUD, GBP, JPY, HKD, SGD, NZD, CHF, CAD, EUR, and USD. Choosing the best option for you and avoiding additional conversion fees is very convenient.

Despite the low fees, the minimum deposit is average, allowing you to take advantage of account-based currencies and avoid conversions.

IC Markets Deposit Options

- Cards.

- PayPal.

- Bank Transfer including local ones.

- Neteller, Skrill, WebMoney, Qiwi.

- China UnionPay, FasaPay and more.

IC Markets minimum deposit

For the Standard Account on MetaTrader4, as well as the other two account types available at IC Markets, the minimum deposit is 200$.

IC Markets Withdrawals

Withdrawals can be made using popular methods such as Bank Transfer, WebMoney, Cards, and e-wallets. IC Markets doesn't charge a deposit fee and charges a withdrawal fee of 0$. However, for International Bank Wire withdrawals, IC Markets deducts the transfer fees charged by the company's banks, which are approximately AUD 20.

How long does withdrawing money from IC Markets take?

Withdrawal money will be processed within the defined time frame for various payment methods, while the accounting team confirms transactions within 1-2 business days for IC Markets.

IC Markets Fees and Spreads

Depending on the account type and platform you choose, IC Markets offers a slightly different range of trading fees. You should also be aware that various IC Markets entities in different jurisdictions may have their own trading conditions.

Fees are generally reasonable. The terms and conditions of some deposit and withdrawal methods should be read in full before making the deposit or withdrawal.

| Fees | IC Markets Fees | AvaTrade Fees | eToro Fees |

|---|---|---|---|

| Deposit Fee | No | No | No |

| Withdrawal Fee | No | No | No |

| Inactivity Fee | No | Yes | Yes |

| Fee ranking | Low | Average | High |

IC Markets Spreads

Standard Accounts are enabled through MetaTrader4 along with CNS VPS Cross-Connect. Spreads are 1.0 pips. On MT4, True ECN accounts or Raw accounts offer micro lots from 0.01 size, deeper institutional grade liquidity, ECN spreads from 0 pips, and a commission of 3.50$ per 100k traded.

There are approximately the same features as MT4 with a cTrader ECN account, but the platform is primarily used by professional traders. Spreads start at 0.0 pips, and commissions are 3.00$ per 100k traded through Equinix LD5.

Considering spreads are among the lowest in the industry, spreads for currency trading are considered very good. It depends on the entity offering the instrument whether the fees are higher than average.

Trading Fees of IC Markets

| Asset/ Pair | IC Markets Spread | AvaTrade Spread | eToro Spread |

|---|---|---|---|

| EUR USD Spread | 1 pip | 1.3 pip | 3 pip |

| Crude Oil WTI Spread | 5 pip | 3 pip | 5 pip |

| Gold Spread | 1 point | 40 | 45 |

Overnight Fee

The overnight fee or swap rate for IC Markets depends on the overnight interest rate differential between the two currencies in the pair and whether the position is a buy or sell. Initially, fees vary by currency, but you should always keep in mind that it may either negatively or positively affect your account.

IC Markets Leverage

Leverage is based on the entity you trade with IC Markets. A relatively small or low initial deposit is required to cover margins on leverage, which initially gives retail traders access to the forex market. Gains can be magnified by using leverage, but losses can also exceed your deposit when using leverage.

- Maximum of 1:30 is available for Australian clients.

- 1:30 allowed for European traders.

- 1:500 for an international proposal.

Trading with leverage enables the trader to trade with larger capital and increase potential profits. Our recommendation is for traders to use the tool wisely and to learn how to set up the correct leverage, as well as how to use leverage as defined by IC Markets and particular jurisdictional laws.

IC Markets Trading Platforms

Furthermore, we see that IC Markets Platform provides advanced software proposals in addition to sophisticated technical optimization of execution provided by leading technologies. Since MetaTrader 4 and cTrader are two of the best trading platforms on the market today, IC Markets has direct access to both platforms.

Although MetaTrader 5 has been updated with brand new features, you can still trade through it if you wish.

MT4, MT5, and cTrader are all offered by IC Markets. Additionally, there is excellent research and excellent tools available for all platforms.

Trading Platform Comparison to Other Brokers

| Platforms | IC Markets Platforms | BlackBull Markets Platforms | Plus500 Platforms |

|---|---|---|---|

| MT4 | Yes | Yes | No |

| MT5 | Yes | Yes | No |

| cTrader | Yes | No | No |

| Own Platform | No | No | Yes |

Desktop Platform

There are different versions of each platform you can use directly from your browser or via the Web Platform. Using MetaTrader or cTrader on your desktop gives you full customization options.

Overall, IC Markets provides comprehensive tools to make trading easier and more enjoyable. The platforms have been enhanced and extended in many ways. MetaTrader 4 offers advanced order types previously not available, such as a market depth, spread monitor, trade risk calculator, and a one-click trade module.

Mobile Platform

Modern traders can also keep up to date with market conditions using mobile apps. In the same way, Android and iOS devices can be used to manage and control positions of MT4, MT5 and cTrader.

Web trading platform

In IC Markets, MetaTrader provides web trading platforms. It can be customized, translated into many languages, and has a transparent fee report. However, it lacks two-step login and price alerts, and its design is outdated.

IC Markets does not have its own trading platform. MetaTrader 4, a third-party platform, is its most commonly used trading platform. In addition to MetaTrader 4, the broker also offers MetaTrader 5 and cTrader which have their own commission structure. Due to its popularity, MetaTrader 4 was reviewed.

Look and feel

IC Markets' web trading platform is highly customizable. The tabs can be resized and positioned easily. However, some features are hard to find and the platform feels outdated. As an example, adding an asset to the watchlist took some time.

Login and security

IC Markets only supports one-step login. Security changes should include two-step authentication, which would make any company more secure.

Search functions

The search functions are OK.

The assets are listed by category. There was no possibility to manually search for assets using the usual search function by asset's name.

Placing orders

Basic order types are available, but orders such as 'one cancels the other' will not be available.

Order types include:

- Market.

- Limit.

- Stop.

We have an overview of order types if you need more information.

Using order time limits is also possible:

- Good 'til canceled (GTC).

- Good 'til time (GTT).

Alerts and notifications

In the web trading platform IC Markets, price alerts and notifications cannot be set.

Portfolio and fee reports

The fee reports for IC Markets are clear.

Commissions and profit-loss balances are easily accessible. It is possible to download these reports under the 'History' tab, but we were not able to do so.

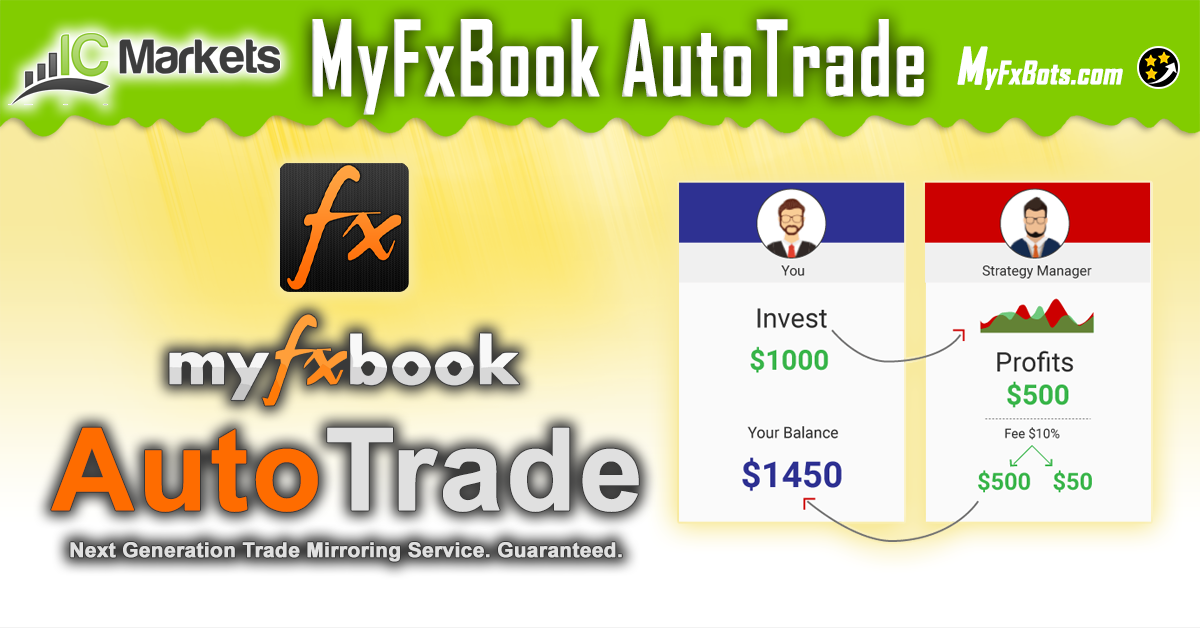

Auto Trading

Also, AutoTrading works on all IC Markets' platforms, including the MT4 or MT5 platform, myfxbook on the cTrader platform, and ZuluTrade. There are thousands of traders on ZuluTrade, which is one of the best social trading platforms, and you can follow their signals for free.

Furthermore, if you wish to enter into a partnership with the IC Markets, there are multi-account management systems like MAM and PAMM that are flexible and easy to use. High-volume traders will benefit from the FIX API, while VPS (Virtual Private Server) offers a range of automated trading strategies with the possibility of receiving free VPS usage (if a minimum volume of 15 round turn (FX) lots is reached each month).

IC Markets Market Instruments

As well as the major market instruments to trade, IC Markets also offers the latest additions like Cryptocurrencies, to suit the demands of any trader. Stocks and bonds, as well as FX, Equities, Commodities, Futures, and CFDs, are some of the asset classes available.

IC Markets Crypto trade offers Bitcoin, Ethereum, Dash, Litecoin, Bitcoin Cash, and Ripple trading pairs. With a leverage of 1:500 and a margin of 20%, you can go long or short.

IC Markets product selection

| IC Markets | Pepperstone | Vantage | |

|---|---|---|---|

| Currency pairs (#) | 65 | 62 | 49 |

| Stock index CFDs (#) | 25 | 23 | 25 |

| Stock CFDs (#) | 2,100 | 1,400 | 800 |

| ETF CFDs (#) | 40 | 110 | 51 |

| Commodity CFDs (#) | 28 | 32 | 22 |

| Bond CFDs (#) | 9 | - | - |

| Cryptos (#) | 13 | 21 | 34 |

Disclaimer: Due to leverage, CFDs carry a high risk of losing money rapidly. Trading CFDs with IC Markets loses money for 74.32% of retail investors. Whether you can afford the high risk of losing your money and whether you understand how CFDs work is important to consider.

UK retail consumers were banned from buying crypto derivatives in 2021 by the FCA.

MetaTrader 5 is the only platform that offers stock CFDs with IC Markets.

Leverage

When trading, you have the option to change the default leverage which is a great feature. You can lower your trade risk by manually changing the pre-set leverage.

Social Trading

A social trading platform called ZuluTrade is offered by IC Markets.

In addition to finding successful traders (ranked by a proprietary algorithm called ZuluRank), ZuluTrade also allows you to follow their trades in your account and convert them into real trades.

Also, you can monitor the volatility of your particular auto-trading strategy with a tool called ZuluGuard if you decide to try ZuluTrade.

IC Markets Safety and Security

IC Markets is constantly monitored and audited by a reputable external agency, so it's considered as a safe broker.

ASIC is the top-tier financial authority that regulates IC Markets. However, the company does not disclose financial information publicly and is not listed on any stock exchange.

IC Markets is regulated by the Cyprus Securities and Exchange Commission (CySEC), the Seychelles Financial Supervisory Authority (FSA), and the Australian Securities and Investments Commission (ASIC).

IC Markets was founded in 2007 in Australia. The company is licensed by the Australian Securities and Investments Commission (ASIC). As a regulated entity in Cyprus, IC Markets offers European clients a legal trading service.

- IC Markets traders can feel completely confident since they are licensed and regulated by ASIC, which is one of the most demanding and strict regulatory bodies in the financial industry. Multi-regulated methods are used to protect client money, including client money segregation, while accounts can only be accessed and traded by clients.

- As a member of the Financial Ombudsman Service (FOS), IC Markets guarantees that disputes between consumers and members are resolved fairly and independently.

The following two facts should be checked before investing in a brokerage:

- When things go wrong, how you are protected.

- The broker's background.

As well as their low latency, broker platforms are well-known for their quick execution of orders. Traders can connect to two Equinix data centers located in London and New York via IC Markets. Dedicated fiber-optic networks in both of these data centers ensure instantaneous order processing.

As a whole, broker trading platforms are highly intuitive and reliable. Besides built-in spread monitoring, these platforms also offer automated trade closing with custom order templates and ladder trading. Aside from offering real-time pricing updates, the platforms also offer live support. Our testing of the trading platforms did not reveal any issues.

A number of titles have been awarded to IC Markets over the years for providing outstanding trading conditions, including:

- ForexBrokers.com 2023 Annual Awards.

- DayTrading.com 2023 Best MT4/MT5 Broker.

- ADVFN International Financial Awards Best ECN Broker 2019.

- Forex Magnates Awards Best Retail Broker Execution 2013 Winner.

- Asia-Pacific Financial Investment Association Financial Institution of the Year 2012.

Your country of residence will determine which of IC Markets' legal entities you can open an account with. You need to know which entity you belong to in order to determine your investor protection amount and regulator.

IC Markets investor protection

| Country of clients | Protection amount | Regulator | Legal entity |

|---|---|---|---|

| EEA, excluding Belgium, Switzerland, Latvia | €20,000 | Cyprus Securities and Exchange Commission (CySEC) | IC Markets (EU) Ltd |

| All other countries, except Australia | No protection | Seychelles Financial Supervisory Authority (FSA) | IC Markets (SC) Ltd |

| Australia | No protection | Australian Securities and Investments Commission (ASIC) | International Capital Markets Pty Ltd |

Retail customers are protected against negative balances by IC Markets. Account balances that go negative are protected.

IC Markets Customer Support

In addition to offering the best technological solutions, IC Markets understands the necessity of good customer service. Customer support is available 24/7, with available IC Markets assist teams around the world.

The phone and email support at IC Markets is superior, and they are available 24 hours a day. IC Markets can be reached at:

- Live chat.

- Phone.

- Email.

The phone support at IC Markets is excellent. Their customer service representative answered all our questions within a minute.

It is very easy to get support via email. Our questions were answered within a day. However, live chat could be improved. Initially, a chatbot offers no relevant answers. Getting a live agent took a long time, and we weren't always satisfied with the answers.

The 24/7 customer support was greatly appreciated.

IC Markets User Experience

In addition to offering superior trading conditions, IC Markets offers a great user experience. The broker offers alarm managers, correlation metrics, and sentiment maps. Trading decisions can be made more informed with the help of these resources and tools. Aside from providing advanced trading support, such as web television and video tutorials, the broker also ensures a full focus on user education.

Customer service representatives at the broker are also well trained and knowledgeable about a variety of topics related to trading, 3rd-party integrations, etc., in order to provide the best support for customers. All inquiries can be handled promptly by the broker's customer service team, which is available 24/7.

Various channels are available for contacting the customer service team, including phone, email, and webchat. Detailed answers to relevant questions can also be found in the FAQ section of the website of the broker. The information can even be searched so that clients with a comfortable search experience can find what they are looking for quickly.

As a result of its excellent user experience, IC Markets is among the best on the market. In order to meet the needs of all its users, the broker places a great deal of emphasis on customer service. Besides excellent platforms, the broker's trading support is also outstanding. In addition to quick trade execution and advanced charting capabilities, IC Markets offers a host of benefits for traders.

IC Markets Education and Training

Having a lot of experience within the forex industry, the IC Markets team knows what traders need to succeed. Free educational materials are available and provide a clear understanding of the topic. A variety of technical analysis reports, video tutorials, informational tools, and webinars are used to accomplish this.

In addition to research tools, platforms offer a variety of analysis tools. Additionally, platforms provide professional traders with tools like Market Analysis Blogs, Economic Calendars, and trading ideas.

There is a lot of value in education services provided by IC Markets. On its website, it provides educational articles, a demo account, and videos about the trading platform.

IC Markets offers the following ways to learn:

- Demo account.

- Platform tutorial videos.

- General educational videos.

- Webinars.

- Quality educational articles.

You can find relevant content in the 'Education' section and on the IC Markets blog. They are both well-structured and cover useful topics. Videos on general education are excellent. The Vimeo and YouTube channels of IC Markets are where you can find these videos.

IC Markets Research

There are comprehensive research tools at IC Markets, including technical analysis, news, and charts. There is no fundamental data available.

Research tools can be found at IC Markets in the following places:

- Under 'Trading Tools' in Client Login.

- Trading platforms MetaTrader 4 and 5.

Our tests included all research tools listed under 'Trading Tools' except charting. A MetaTrader charting tool was used for charting.

Trading ideas

Trading ideas can be found at IC Markets. Indicators and price levels are used to come up with these trading ideas. By clicking on 'Trading Central' or 'Featured Ideas', you can access them.

Fundamental data

There is no fundamental data offered by IC Markets.

Charting

The charting tools in IC Markets are OK. 31 technical indicators are available to you.

A downside is the outdated design and the difficulty in using some features. Taking an indicator off the chart, for example, proved to be difficult.

News feed

'Market Buzz' offers news analytics and sentiment indicators through a visually appealing news feed. A third-party news website such as ForexLive or tickerreport.com opens individual news stories on a separate page, which is cumbersome. X (formerly Twitter) messages clog up the news feed as well.

You may also find these research tools useful

C# is used by IC Markets to offer cAlgo for API trading.

IC Markets Awards and Recognition

Best in Class for Commissions & Fees and Best in Class for MetaTrader

ForexBrokers.com Annual Awards

in 2023A total of eight categories were analyzed for the ForexBrokers.com 2023 Annual Awards: Commissions & Fees, Offering of Investments, Platforms & Tools, Mobile Trading Apps, Research, Education, Trust Score, and Overall.

The Top 7 Forex brokers were awarded Best in Class honors in the following categories: Beginners, Social Copy Trading, Ease of Use, MetaTrader, Algo Trading, Crypto Trading, and Professional Trading.

ForexBrokers.com's exclusive Industry Awards also recognize brokers for their excellence and innovation.

According to these measures, IC Markets was titled as the Best in Class for Commissions & Fees primary category with 5/5 rating and 3 Best in Class Streak. Also was titled as the Best in Class with Rank #1, 3 Streak #1, and 3 Best in Class Streak for MetaTrader secondary category.

Best MT4/MT5 Broker

DayTrading.com

in 2023Among the top MT4 and MT5 integration providers, the IC Markets brand is well known.

The integrations and features of IC Markets have improved steadily over the last few years, even though they haven't won or runner-up over the last few years. Traders can customize their trading styles and frequency patterns.

As a result of MetaQuote's platforms having a higher level of complexity than basic platforms, MetaQuote's platforms receive excellent customer support from IC Markets.

Best ECN Broker

ADVFN International Financial Awards

in 2019A total of 58 categories recognize financial companies and individuals from both established and emerging sectors. Blockchain and cryptocurrency are featured in an extensive category, reflecting the growing market.

Among the winners were bloggers, journalists, exchanges, platforms, and advisers.

"In featuring such a broad group of winners and having a large cryptocurrency and blockchain tranche, the 2019 awards truly reflect the dynamism, diverse offerings, and scope within the financial industry right now," said Clem Chambers, CEO of ADVFN. "It gives us great pleasure to honor the eminent and emerging players that have stood out in the global financial sector over the last 12 months."

Best Retail Broker Execution

Forex Magnates Awards

in 2013With its exceptional execution and tight spreads, IC Markets was shortlisted for 'Best Retail Broker Execution' in the 2013 Forex Magnates Awards. This innovative trading platform will provide clients with direct access to IC Markets' market-leading trading environment.

Financial Institution of the Year

IC Markets Final Thoughts

There is no doubt that IC Markets is one of the best forex brokers out there.

There are low forex fees and opening an account is quick and easy. Withdrawals and deposits are free, and the process is simple. There is a lot of useful information on the website's education section. Also, live chat support could be better.

With competitive spreads and low commissions, IC Markets appeals primarily to algorithmic traders who use MT4, MT5, or cTrader platforms.

Because automated trading strategies have a higher turnover than manual ones, IC Markets is able to achieve significantly higher trading volumes than its peers.

Retail forex and CFD traders will find IC Markets's overall offering appealing with third-party social trading services like MyFxBook and ZuluTrade. It is generally not recommended to trade with IC Markets unless you are a spread-sensitive algorithmic trader or use a manual trading strategy that is sensitive to spreads.

Investors looking to automate their trading strategies should choose IC Markets. IC Markets offers a growing selection of educational and research materials, as well as social copy trading platforms.

As a result, the IC Markets offers a wide range of advanced trading features, which can be tailored to almost any trading parameter by offering a wide range of tailored solutions. These include selecting an instrument to trade, a platform to use, opening an account, using auto trading, social trading, or even becoming a partner.

Aside from the high level of execution, platform optimization, range of tools, and support provided, IC Markets technical optimization is among the strongest.

As a result of Our findings and Financial Expert Opinion, we recommend IC Markets for:

- Beginning Traders.

- Professional Traders.

- Traders who prefer MT4 or MT5 platform or cTrader.

- EAs running.

- Algorithmic or API Traders.

- Currency Trading.

- Suitable for a Variety of Trading Strategies.

Latest IC Markets Posts

MyFxBots Admin

[Last Modified On Thurs, 21 Sep 2023]Talk about IC Markets

Information, charts or examples contained in this review article are for illustration and educational purposes only. It should not be considered as an advice or endorsement to purchase or sell any security or financial instrument. We do not and cannot give any kind of financial advice. No employee or persons associated with us are registered or authorized to give financial advice. We do not trade on anyone's behalf, and we do not recommend any broker. On certain occasions, we have a material link to the product or service mentioned in the article. This may be in the form of compensation or remuneration.

-

Social & Feed

- @myfxbots

- @myfxbots.Expert.Advisors

- @myfxbots.expert.advisors

- @myfxbots.expert.advisors

- @myfxbots_eas

- @myfxbots

- @myfxbots

- @myfxbots

- @myfxbots

- @myfxbots

Tags

Forex Combo System WallStreet Forex Robot 3.0 Domination Omega Trend Broker Arbitrage FX-Builder Forex Diamond Volatility Factor Pro GPS Forex Robot Tick Data Suite Vortex Trader PRO Forex Trend Detector Swing Trader PRO RayBOT Forex Gold Investor FXCharger Best Free Scalper Pro Gold Scalper PRO News Scope EA PRO Smart Scalper PRO FX Scalper Evening Scalper PRO Waka Waka Golden Pickaxe Perceptrader AI Happy Bitcoin Algocrat AI Traders Academy Club Quant Analyzer AlgoWizard Quant Data Manager FXAutomater InstaForex RoboForex IronFX Tickmill FXVM Alpari FX Choice TradingFX VPS Commercial Network Services VPS Forex Trader QHoster GrandCapital FBS FX Secret Club StrategyQuant X Happy Forex LeapFX Trading Academy ForexTime Magnetic Exchange XM BlackBull Markets ForexSignals.com Libertex AMarkets HFM Broker FxPro Binance ACY Securities IV Markets Forex VPS MTeletool Forex Store Valery Trading Telegram Signal Copier Telegram Copier Forex Robot Academy Forex Robot Factory (Expert Advisor Generator) SMRT Algo EGPForex

Risk

Forex trading can involve the risk of loss beyond your initial deposit. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Forex accounts typically offer various degrees of leverage and their elevated profit potential is counterbalanced by an equally high level of risk. You should never risk more than you are prepared to lose and you should carefully take into consideration your trading experience.

Past performance and simulated results are not necessarily indicative of future performance. All the content on this site represents the sole opinion of the author and does not constitute an express recommendation to purchase any of the products described in its pages.