We showed in the previous posts how Quant Analyzer is the most powerful tool among those known to analyze trading strategy and portfolio performance by importing the previously generated backtest of the currently running live trading results and expose them to an advanced process of analysis including periodic performance analysis as by the hour, day, day of the week, month and more, strategy stagnation time, advanced stats as Sharpe ratio, R Expectancy and more and performance and correlation of a strategy in a portfolio and much more!

This advanced tool can deal with and import data to be analyzed from the following trading data result sources:

and more services and platforms will be included by time!

The Importance of Strategy or Portfolio Performance Analysis

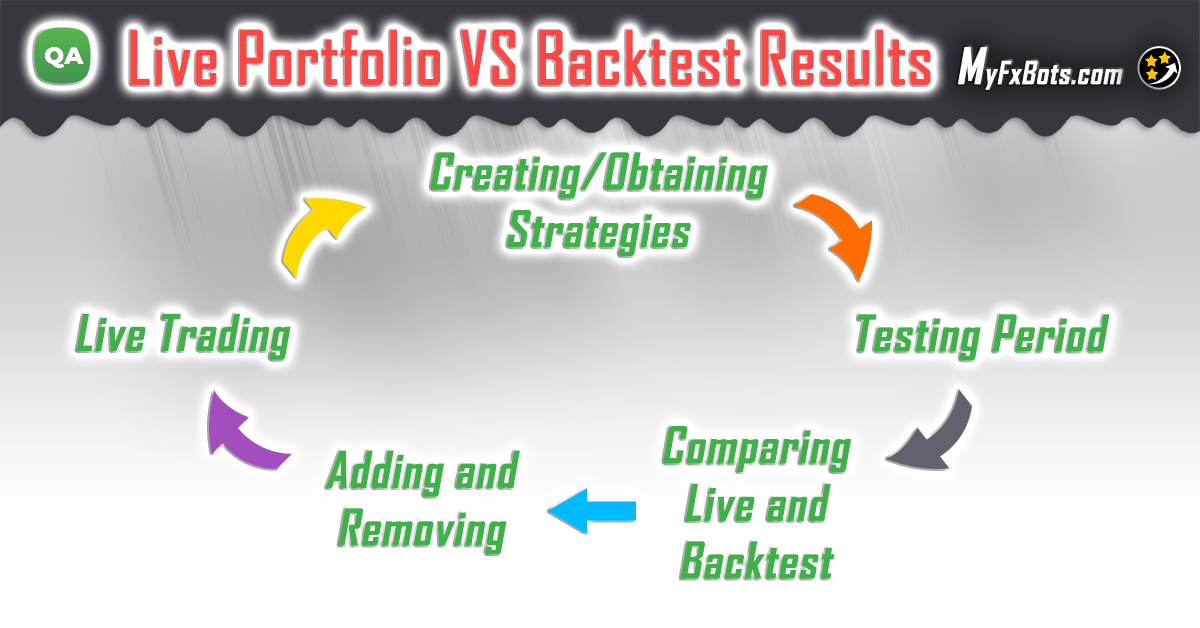

For safe real money trading, it's required to be aware of every possible detail concerning the strategy employed.

The majority of trading platforms lack the ability to generate advanced trading performance analysis using tools like Monte Carlo simulation or What-If analysis besides that they also lack the tools necessary for optimal portfolio building.

But now, and thanks to Quant Analyzer a strategy and portfolio performance can be taken simply to the next level of analysis which may form the fundamental difference between failure and success in trading.

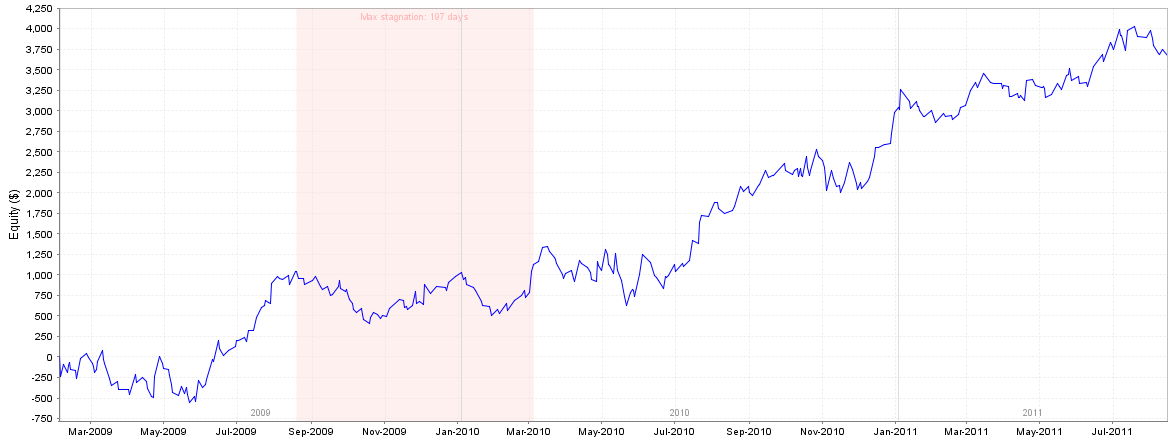

It can generate and display more advanced statistics like profits consistency and what to expect; regarding drawdown, stagnation, and monthly/yearly results for any strategy before employing it in real money trading.

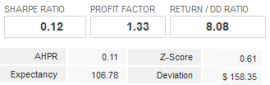

It's able to compute over 60 different performance statistics including Sharpe ratio, Expectancy, and System Quality Number, moreover, it allows you to implement your own favorite statistics to apply to your strategy.

Quant Analyzer Can Find A Solution For

- The expected trading behavior of your strategy in conjugation with other strategies.

- The quality of the strategy alone and in comparison to other strategies backtested.

- Weekly variations in the strategy performance to detect the best and worst days of the week to use the strategy.

- The expected average monthly or yearly return for running the strategy.

- Determine the longest period during which the strategy stagnates before proceeding to profits generation.

That's why Quant Analyzer is considered by any serious trader as an absolutely essential tool.

Its ability to make a clear differential recognition of the daily and hourly profiting and trading performance of an EA using the statistical analysis provided could form a strong shield for you against costly losses that the EA flaws could make in the past.

New Features in the Latest Version 4

For Standard Users

Plenty of new features and improvements were applied to the latest version, nearly all the program parts were improved.

- The Equity chart has new interesting features.

- The software now supports importing data from the most popular platforms like MT4, MT5, MyfxBook, NinjaTrader, TradeStation, and others will be added soon.

- New Home dashboard screen with a history of the most recently opened and saved files.

- New Overview tab templates.

- Advanced improvements for the Portfolio correlation with extendable correlation computer.

Portfolio Master: It's probably the most important among all the newly added features, it's a tool that can determine an "optimal" portfolio from the available strategies analyzed by the software.

For Advanced users

Openness and Extensibility is the most important feature of the new version.

StrategyQuant Platform Plugin / Snippets architecture: It's the new core of Quant Analyzer version 4.0 which allows:

- The Software Developers:

- To design and prepare much more faster and efficient updates and new features and developments for the software.

- The Software Users:

- To see and verify the formulas and algorithms applied by the software in the majority of the computations it performs.

- To extend the program capabilities by implementing his own ideas and features to use and apply live, so he can:

- Compute new statistical values from his own trades.

- Add new charts to the Trade Analysis panel.

- Add support for the new import format.

All the included algorithms and statistics computations in the software are open source in the form of code snippets allowing the user to check how they work with the ability to make any further modifications or even add new statistics to the bundle.

This is not limited only to the program's main computing functions but extends almost to every component of the software as portfolio correlation computing for example where new columns and actions can be added into the databank and new charts can be also created in Trade analysis.

This doesn't replace the standard usage of the software in any way and the user can still use it without making any extensions and benefit from the community efforts and the new high rate of improvements adding to the software.

Download the Beta Version of Quant Analyzer 4

Until now the program is still in its Beta stage, so bugs and non-working functions are expected, besides that Snippets architecture and dependencies might be changed by the developers.

Like the standard Quant Analyzer version 3.0 (Free version) some functions are only in a trial or limited mode.

Latest Quant Analyzer Posts

MyFxBots Admin

[Last Modified On Sat, 11 Apr 2015]Other StrategyQuant X Forex Robots

Talk about Quant Analyzer

Information, charts or examples contained in this blog post are for illustration and educational purposes only. It should not be considered as an advice or endorsement to purchase or sell any security or financial instrument. We do not and cannot give any kind of financial advice. No employee or persons associated with us are registered or authorized to give financial advice. We do not trade on anyone's behalf, and we do not recommend any broker. On certain occasions, we have a material link to the product or service mentioned in the article. This may be in the form of compensation or remuneration.

-

Social & Feed

- @myfxbots

- @myfxbots.Expert.Advisors

- @myfxbots.expert.advisors

- @myfxbots.expert.advisors

- @myfxbots_eas

- @myfxbots

- @myfxbots

- @myfxbots

- @myfxbots

- @myfxbots

Tags

Forex Combo System WallStreet Forex Robot 3.0 Domination Omega Trend Broker Arbitrage FX-Builder Forex Diamond Volatility Factor Pro GPS Forex Robot Tick Data Suite Vortex Trader PRO Forex Trend Detector Swing Trader PRO RayBOT Forex Gold Investor FXCharger Best Free Scalper Pro Gold Scalper PRO News Scope EA PRO Smart Scalper PRO FX Scalper Evening Scalper PRO Waka Waka Golden Pickaxe Perceptrader AI Happy Bitcoin Algocrat AI Traders Academy Club AlgoWizard Quant Data Manager FXAutomater InstaForex RoboForex IronFX Tickmill FXVM Alpari FX Choice TradingFX VPS Commercial Network Services VPS Forex Trader QHoster GrandCapital IC Markets FBS FX Secret Club StrategyQuant X Happy Forex LeapFX Trading Academy ForexTime Magnetic Exchange XM BlackBull Markets ForexSignals.com Libertex AMarkets HFM Broker FxPro Binance ACY Securities IV Markets Forex VPS MTeletool Forex Store Valery Trading Telegram Signal Copier Telegram Copier Forex Robot Academy Forex Robot Factory (Expert Advisor Generator) SMRT Algo EGPForex

Risk

Forex trading can involve the risk of loss beyond your initial deposit. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Forex accounts typically offer various degrees of leverage and their elevated profit potential is counterbalanced by an equally high level of risk. You should never risk more than you are prepared to lose and you should carefully take into consideration your trading experience.

Past performance and simulated results are not necessarily indicative of future performance. All the content on this site represents the sole opinion of the author and does not constitute an express recommendation to purchase any of the products described in its pages.