As we all know, risk management would secure our profits on long term, but what if we put risk management rules aside and advanced without it?

This is an example:

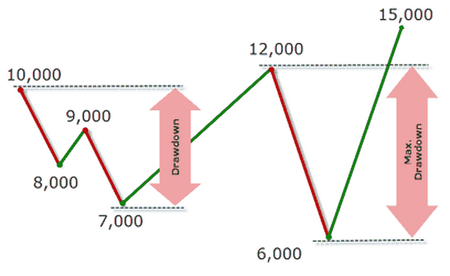

If you have $10,000 and lost $5,000, this is a 50% loss of your account.

In other words, this is a 50% drawdown.

A drawdown term can be simply understood as the decrease in the starting capital after passing through a series of losses.

It's net value can be calculated as the difference between a relative peak minus a relative drop in the capital and it's usually noted by traders as a percentage of their accounts.

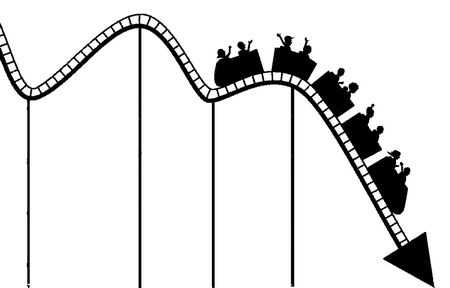

Losing Streak

An edge is the what every trader always looks for while trading and its why trading systems are being developed by Forex coders. A Forex system with 70% profits over a reasonable period of time is considered providing a very good edge, but this doesn't necessarily mean that it'd win 70 trades out of every 100 as we don't know the real 100% total trades count out of which it'd win those 70%, right?

Moreover, if it would be really 70 winning trades out of 100 in count, you may also have the 30% (30 trades) loss in a row before winning the remaining 70, a very few traders are capable to stay in game throughout this apparently false predominating loss.

Moreover, if it would be really 70 winning trades out of 100 in count, you may also have the 30% (30 trades) loss in a row before winning the remaining 70, a very few traders are capable to stay in game throughout this apparently false predominating loss.

Here it comes, the importance of risk management. Whatever the Forex system you are using and how much experienced in Forex trading you are, a losing streak will eventually supervene, professionals yet still end up profitable.

This is as a professional trader knows how to practice risk management and well recognizes that he will not win every session he trades, beside that he risks a small percentage of his total capital, so he can survive those losing streaks.

You must do this too in you your trading. Drawdowns are an integral part of trading and a trading plan that gives you the ability to withstand those large losses periods is the main key for success in Forex trading, and having risk management rules is a chief part of that trading plan.

Be sure to risk only a small percentage of your total capital to survive your losing streaks and be certain that strict money management rules will make everything under your control and finally you will always be a winner.

MyFxBots Admin

[Last Modified On Mon, 2 Mar 2015]Other StrategyQuant X Forex Robots

Talk about Quant Data Manager

Information, charts or examples contained in this blog post are for illustration and educational purposes only. It should not be considered as an advice or endorsement to purchase or sell any security or financial instrument. We do not and cannot give any kind of financial advice. No employee or persons associated with us are registered or authorized to give financial advice. We do not trade on anyone's behalf, and we do not recommend any broker. On certain occasions, we have a material link to the product or service mentioned in the article. This may be in the form of compensation or remuneration.

-

Social & Feed

- @myfxbots

- @myfxbots.Expert.Advisors

- @myfxbots.expert.advisors

- @myfxbots.expert.advisors

- @myfxbots_eas

- @myfxbots

- @myfxbots

- @myfxbots

- @myfxbots

- @myfxbots

Tags

Forex Combo System WallStreet Forex Robot 3.0 Domination Omega Trend Broker Arbitrage FX-Builder Forex Diamond Volatility Factor Pro GPS Forex Robot Tick Data Suite Vortex Trader PRO Forex Trend Detector Swing Trader PRO RayBOT Forex Gold Investor FXCharger Best Free Scalper Pro Gold Scalper PRO News Scope EA PRO Smart Scalper PRO FX Scalper Evening Scalper PRO Waka Waka Golden Pickaxe Perceptrader AI Happy Bitcoin Algocrat AI Traders Academy Club Quant Analyzer AlgoWizard FXAutomater InstaForex RoboForex IronFX Tickmill FXVM Alpari FX Choice TradingFX VPS Commercial Network Services VPS Forex Trader QHoster GrandCapital IC Markets FBS FX Secret Club StrategyQuant X Happy Forex LeapFX Trading Academy ForexTime Magnetic Exchange XM BlackBull Markets ForexSignals.com Libertex AMarkets HFM Broker FxPro Binance ACY Securities IV Markets Forex VPS MTeletool Forex Store Valery Trading Telegram Signal Copier Telegram Copier Forex Robot Academy Forex Robot Factory (Expert Advisor Generator) SMRT Algo EGPForex

Risk

Forex trading can involve the risk of loss beyond your initial deposit. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Forex accounts typically offer various degrees of leverage and their elevated profit potential is counterbalanced by an equally high level of risk. You should never risk more than you are prepared to lose and you should carefully take into consideration your trading experience.

Past performance and simulated results are not necessarily indicative of future performance. All the content on this site represents the sole opinion of the author and does not constitute an express recommendation to purchase any of the products described in its pages.

![[FREE] Download Dukascopy tick data for realistic backtesting](https://www.myfxbots.com/assets/media/products/forex-service/1200-628/strategyquant-tickdatadownloader.png)