The momentum strategy is based on the idea that if there is enough force behind a price move, it will continue to move in the same direction. In other words, if a trend is well-established, it will likely continue as more traders and investors try not to miss out on the price move. The strategy takes advantage of investor herding mentality, also known as FOMO (fear of missing out), which drives the price in one direction.

To break it down a bit, when a stock reaches a higher price, it usually attracts more attention from traders and investors, which pushes the market price even higher. The price would continue to rise until something happens to make people start dumping the stock.

Once enough sellers are in the market, the momentum changes direction and forces the stock price down. Short-sellers would take advantage of the downside momentum to sell short and cover at a lower price.

Essentially, the momentum trading strategy seeks to take advantage of market volatility by taking short-term positions in stocks going up and selling them as soon as they show signs of going down. The investor then moves the capital to other stocks showing momentum. So, the market volatility is like waves in the ocean, with the momentum trader sailing up the crest of one, only to jump to the next wave before the first wave crashes down again.

It is important to note that momentum trading is not a long-only strategy. Some traders use a combination of both long and short approaches. Taking long positions in stocks with high upside momentum and short positions in stocks with a high downside momentum.

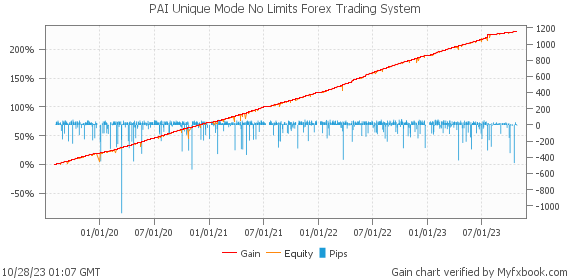

No Grid, No Hedging, No Martingale, and No Massive StopLoss. But a strong evolved Money Management System.

The next step before starting a trade is to compare such an opportunity to price action for verification, this confirms an impending reversal of the trend direction.

Then the trade entry becomes so favorable and that trade is highly promising and the system puts an order.

-

Social & Feed

- @myfxbots

- @myfxbots.Expert.Advisors

- @myfxbots.expert.advisors

- @myfxbots.expert.advisors

- @myfxbots_eas

- @myfxbots

- @myfxbots

- @myfxbots

- @myfxbots

- @myfxbots

Tags

Forex Combo System WallStreet Forex Robot 3.0 Domination Omega Trend Broker Arbitrage FX-Builder Forex Diamond Volatility Factor Pro GPS Forex Robot Tick Data Suite Vortex Trader PRO Forex Trend Detector Swing Trader PRO RayBOT Forex Gold Investor FXCharger Best Free Scalper Pro Gold Scalper PRO News Scope EA PRO Smart Scalper PRO FX Scalper Evening Scalper PRO Waka Waka Golden Pickaxe Perceptrader AI Happy Bitcoin Algocrat AI Traders Academy Club Quant Analyzer AlgoWizard Quant Data Manager FXAutomater InstaForex RoboForex IronFX Tickmill FXVM Alpari FX Choice TradingFX VPS Commercial Network Services VPS Forex Trader QHoster GrandCapital IC Markets FBS FX Secret Club StrategyQuant X Happy Forex LeapFX Trading Academy ForexTime Magnetic Exchange XM BlackBull Markets ForexSignals.com Libertex AMarkets HFM Broker FxPro Binance ACY Securities IV Markets Forex VPS MTeletool Forex Store Valery Trading Telegram Signal Copier Telegram Copier Forex Robot Academy Forex Robot Factory (Expert Advisor Generator) SMRT Algo EGPForex

Risk

Forex trading can involve the risk of loss beyond your initial deposit. It is not suitable for all investors and you should make sure you understand the risks involved, seeking independent advice if necessary.

Forex accounts typically offer various degrees of leverage and their elevated profit potential is counterbalanced by an equally high level of risk. You should never risk more than you are prepared to lose and you should carefully take into consideration your trading experience.

Past performance and simulated results are not necessarily indicative of future performance. All the content on this site represents the sole opinion of the author and does not constitute an express recommendation to purchase any of the products described in its pages.